DiFC & ZA'ABEEL

The Global Financial Hub

Area of British legislation within the UAE, adjacent to Dubai Downtown. DIFC provides a distinctive combination of top-tier infrastructure, supportive business policies, dynamic ecosystem, and the renowned fashion hub of galleries and premier dining spots, Gate Village. A forward-thinking regulatory system, tax benefits, and an investor-friendly atmosphere make it an attractive location for enterprises pursuing growth and potential.

LATEST LAUNCHES

FOUR SEASONS Private Residences DiFC

Av.starting PRICE: 6'340 AED/sqft, Remaining SIZES from: 3'623 sqft in 2-Br, Handover: Q4 2027, PP: 60/40. NUMBER OF UNITS: 59

EDEN HOUSE ZA'ABEEL

Av.starting PRICE: 4'150 AED/sqft, SIZES from: 1'132 sqft in 1-Br, Handover: Q4 2028, PP: 50/50. Floor Levels: G+39

ONE ZABEEL, ONE&ONLY

Ready project. Available only at Secondary Market

ADDRESS RESIDENCES ZABEEL DIFC VIEW

Under construction. Sold out. Handover: Q3 2029

DIFC Heights

Sold out. Handover: Q3 2029

DiFC LIVING

Sold out. Handover: Q4 2026

AKALA, prelaunch

Av.starting PRICE 3'700 AED/sqft, SIZES from: 1'036 sqft in 1-Br, Handover: Q3 2029, PP: 60/40. EOI - 100k AED

Jumeirah Residences Emirates Towers

Av.starting PRICE: 4'000 AED/sqft, SIZES from: 861 sqft in 1-Br, Handover: Q3 2030, PP: 60/40. G + 59floors

JANU

Price, AED per sqft: 7'300. Starting from size: 3'000 sqft, at a 2br unit. HO: Q4 2029. PP: 50/50. Total amount of Residences: 57 units, Fully Furnished and Fitted.

SOL LUXE

Price, AED per sqft: 3'250. Starting from size: 800 sqft, at a 1br unit. HO: Q4 2028. PP: 50/50.

TRUMP Tower

Price, AED per sqft: 4'200. Starting from size: 952 sqft, at a 2br unit. HO: Q4 2031. PP: 90/10. Number of Units: 800. 80 floors.

AHS Commercial Tower (Premium Offices)

Av.starting PRICE 4'000 AED/sqft, SIZES from: 2'964 sqft for half-floor. Handover: Q4 2026, PP: 60/40. 69 levels, 500+ parking slots. Luxury Wellness Facilities (SPA, Gym, Cigar Lounge)

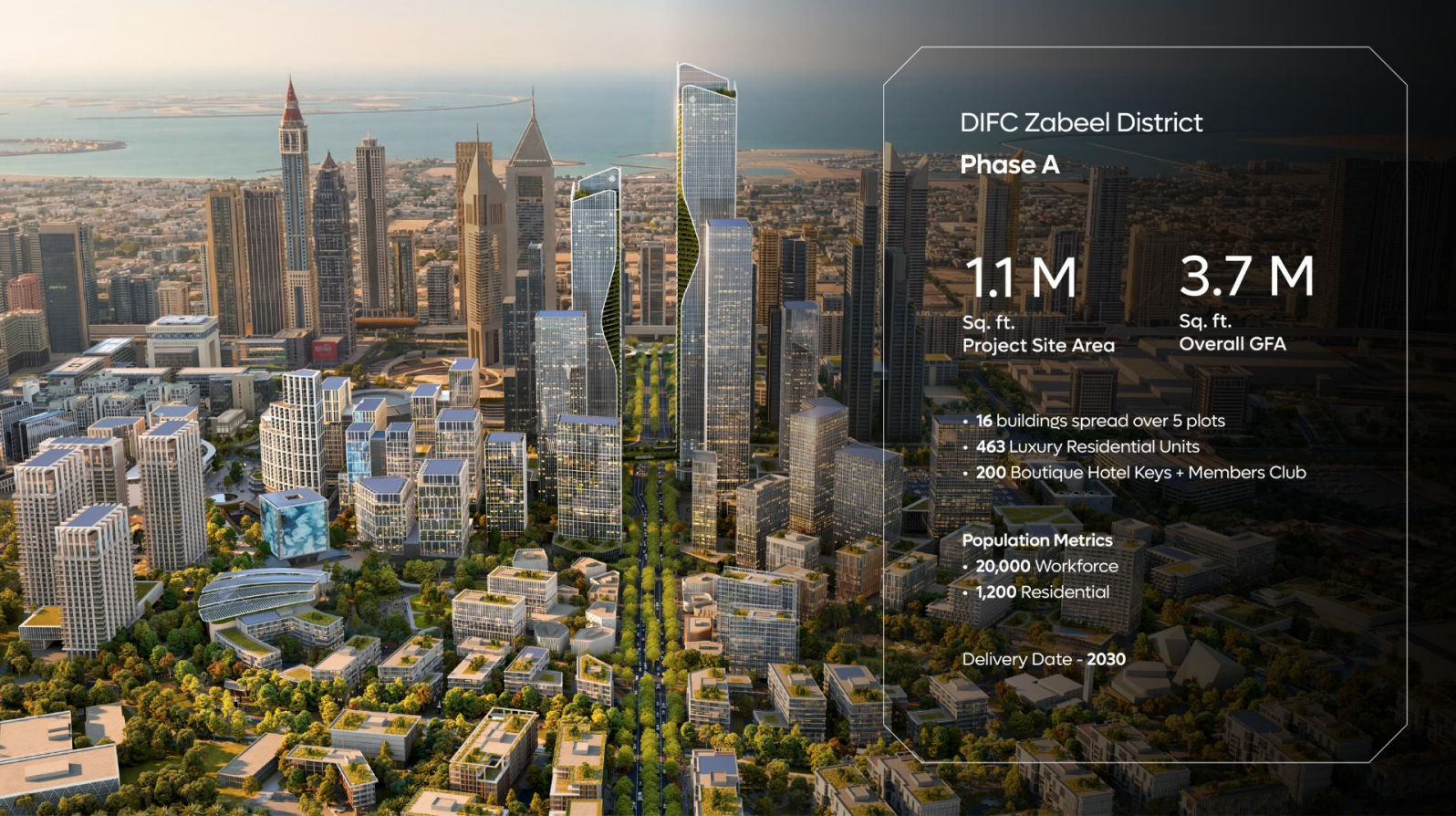

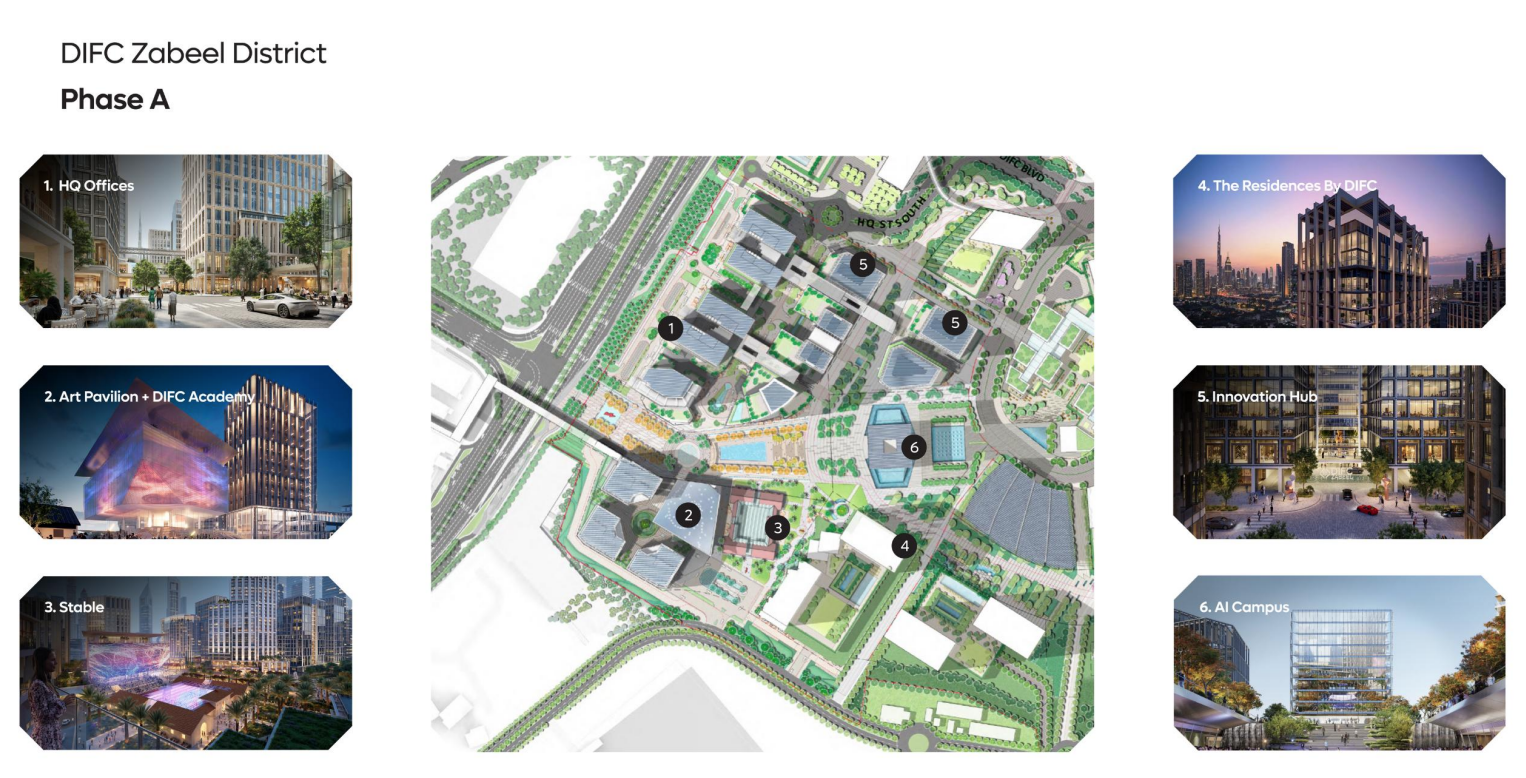

The RESIDENCES DIFC-2-ZA'ABEEL DISTRICT

Price, AED per sqft: 3'900. Starting from size: 845 sqft, at a 1br unit. HO: Q4 2029. PP: 70/30.

.

.

DIFC Overview:

Dubai’s Financial Powerhouse and Emerging Luxury Hub

Dubai International Financial Centre (DIFC) is more than just the region’s leading financial district—it is rapidly evolving into a high-end residential and lifestyle destination, attracting global investors, corporate executives, and luxury buyers. With a limited supply of ultra-luxury properties and an ever-growing demand for exclusive living, DIFC presents one of the most compelling real estate investment opportunities in 2025.

Market Overview: A High-Demand, Low-Supply District

✅ Sustained Price Growth

DIFC remains a low-density, high-value market with limited land for new developments, leading to consistent property appreciation.

In 2023-2024, property prices in DIFC rose by 10-15%, outpacing many other prime Dubai districts.

✅ Elite Tenant Market & Strong Rental Yields

With Dubai’s financial sector booming, executives, bankers, and global investors continue to demand premium living spaces near their workplaces.

Luxury apartments in DIFC generate rental yields of 7-9%, significantly higher than London, New York, or Singapore’s financial hubs.

✅ Global Investment Confidence

DIFC operates under a separate legal and financial framework, attracting top-tier global corporations, venture capital firms, and fintech startups.

Dubai’s business-friendly policies continue to drive corporate expansions, increasing demand for ultra-premium housing.

Challenges & Opportunities

✅ Pros:

✔ High Liquidity Market – DIFC’s properties attract institutional investors and ultra-high-net-worth individuals (UHNWIs), making resale easier.

✔ Tax-Free Environment – Zero income tax and corporate tax benefits attract global capital.

✔ Future Infrastructure Growth – Expanding business districts, upcoming lifestyle enhancements, and improved connectivity boost long-term value.

⚠️ Cons:

🚧 Limited New Supply – New projects are rare, meaning investors must act quickly to secure prime units.

🚧 Higher Entry Costs – Property prices in DIFC are higher compared to other districts, but the ROI compensates for the premium investment.

A Secure, High-Growth Investment.

DIFC offers one of the most stable and high-performing real estate markets in Dubai, driven by demand from global investors, corporate professionals, and high-net-worth buyers. With limited ultra-luxury supply and continued capital appreciation, DIFC remains a strategic choice for investors seeking exclusivity, strong ROI, and long-term wealth growth.

Looking to invest in DIFC’s most prestigious properties? – Contact us for exclusive listings and expert insights.