MEYDAN HORIZON

Sobha One

Av.Starting PRICE: 2'500 AED/sqft, Available SIZEs from 808 sqft in 1-BR, HO: Q4 2026, Expected Service Charges: 15 AED/sqft. PP: 40/60

MANSORY Residences

Av.Starting PRICE: 2'900 AED/sqft, Available SIZEs from 906 sqft in 1-BR. HO: Q4 2028. Configuration: G+8P+48 floors. Expected Service Charge: 18 AED/sqft. PP: 50/50.

The SYMPHONY

Av.Starting PRICE: 2'850 AED/sqft, Available SIZEs from 630 sqft in 1-BR, HO: Q2 2029, Expected Service Charges: 20 AED/sqft. PP: 40/60

The HIGHGROVE

Av.Starting PRICE: 2'700 AED/sqft, Available SIZEs from 800 sqft in 1-BR, HO: Q4 2027, Configuration: G+4P+31 floors + R. Expected Service Charges: 18 AED/sqft. PP: 70/30

BELGROVE Residences

Av.Starting PRICE: 2'350 AED/sqft, Available SIZEs from 756 sqft in 1-BR. HO: Q3 2027. Configuration: G+4P+26+R floors. Expected Service Charge: 18 AED/sqft. PP: 70/30.

RIVERTON House

Av.Starting PRICE: 2'750 AED/sqft, Available SIZEs from 789 sqft in 1-BR, HO: Q2 2028, G + 4P + 19 floors + R. Expected Service Charges: 16 AED/sqft. PP: 70/30

The CADEN

Av.Starting PRICE: 2'350 AED/sqft, Available SIZEs from 833 sqft in 1-BR, HO: Q3 2028. Expected Service Charges: 18 AED/sqft. PP: 60/40

WYNWOOD Horizon

Av.Starting PRICE: 2'650 AED/sqft, Available SIZEs from 755 sqft in 1-BR. HO: Q2 2028. Configuration: G+4P+18+R floors. Expected Service Charge: 18 AED/sqft. PP: 60/40.

ROVE HOME

Av.Starting PRICE: 2'760 AED/sqft, Available SIZEs from 586 sqft in 1-BR, HO: Q4 2029, B+G+4P+20 floors. Expected Service Charges: 24 AED/sqft. PP: 50/50

STAMN MIA Tower

Av.Starting PRICE: 2'350 AED/sqft, Available SIZEs from 610 sqft in 1-BR, HO: Q2 2028. Expected Service Charges: 20 AED/sqft. PP: 50/50

HELVETIA VERDE

Av.Starting PRICE: 1'950 AED/sqft, Available SIZEs from 853 sqft in 1-BR. HO: Q1 2028. Configuration: G+2P+17 floors. Expected Service Charge: 18 AED/sqft. PP: 60/40.

AL VISTA

Av.Starting PRICE: 2'100 AED/sqft, Available SIZEs from 788 sqft in 1-BR, HO: Q4 2027, G+4P+39 floors. Expected Service Charges: 14 AED/sqft. PP: 80/20

CLAYDON House

Av.Starting PRICE: 2'850 AED/sqft, Available SIZEs from 789 sqft in 1-BR, HO: Q2 2027, G + 5P + 38 floors. Expected Service Charges: 22 AED/sqft. PP: 70/30

PARKWAY

Av.Starting PRICE: 2'100 AED/sqft, Available SIZEs from 729 sqft in 1-BR. HO: Q1 2028. Configuration: G+P+32+R floors. Expected Service Charge: 16 AED/sqft. PP: 65/35.

The WATERWAY

Av.Starting PRICE: 1'250 AED/sqft, Available SIZEs from 1'328 sqft in 1-BR, HO: Q4 2026, G+4P+17 floors. Expected Service Charges: 15 AED/sqft. PP: 65/35

Investor-focused overview of Meydan Horizon in Dubai

– a rapidly emerging real-estate hotspot with both strong growth potential and some practical considerations:

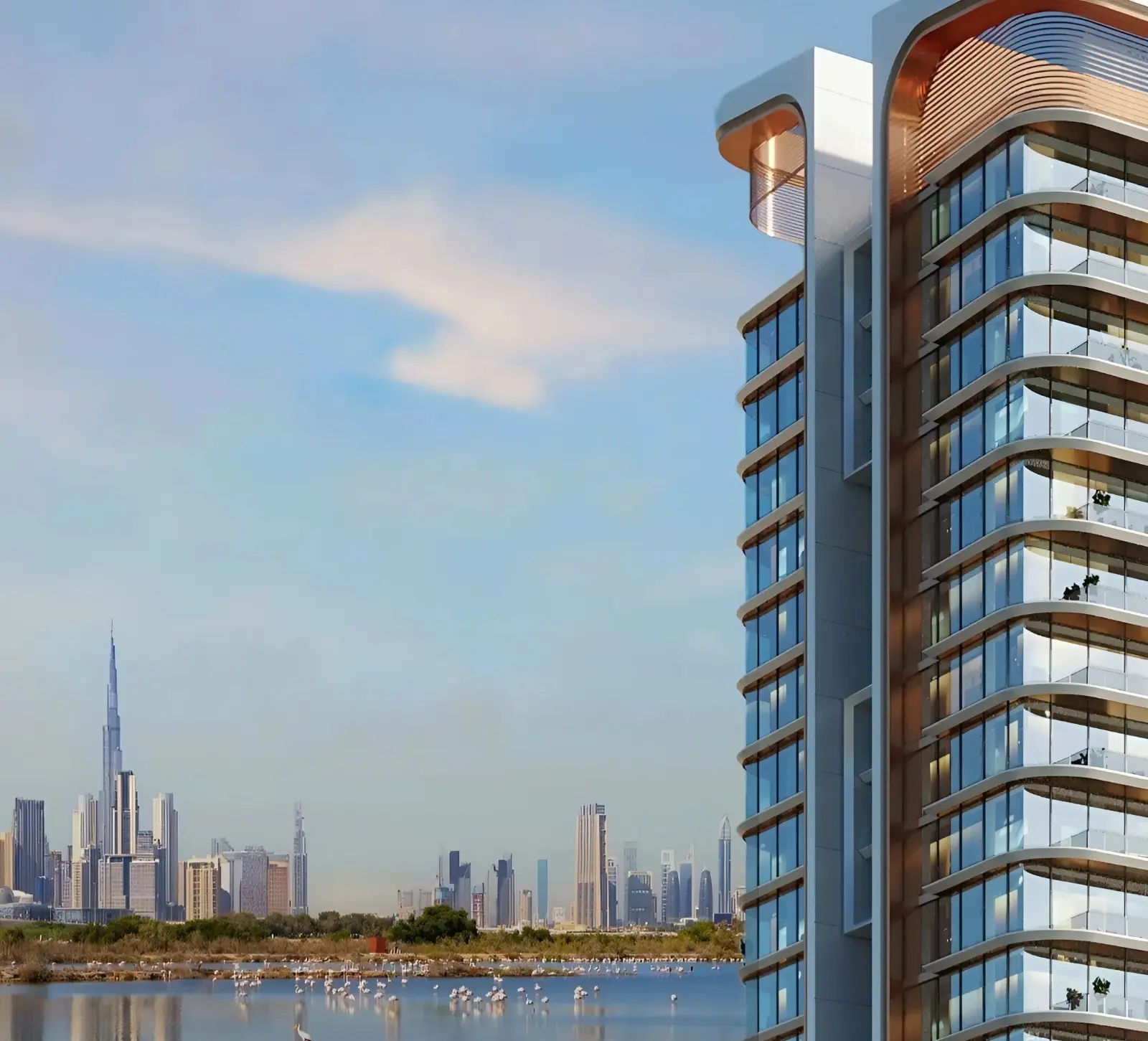

What & Where: Meydan Horizon (Meydan, Dubai)

Meydan Horizon is part of the larger Meydan district within Mohammed Bin Rashid City (MBR City) – a master-planned community blending residential, retail, commercial and leisure spaces with waterfront promenades and green corridors. The development benefits from views over Ras Al Khor Wildlife Sanctuary, panoramic city skyline sights and comprehensive mixed-use planning that appeals to modern investors.

📈 Investment Perspective

🌟 Pros (Strengths)

1. Strategic Location

Central Dubai positioning with quick road access to Business Bay, Downtown Dubai, and DXB Airport – major hubs for tenants and end-users alike.

Proximity to key infrastructure like Al Khail Road and Sheikh Mohammed Bin Zayed Road makes commuting efficient for residents and appealing for renters/business occupiers.

2. Strong Capital Appreciation Potential

Analysts highlight ongoing infrastructure development and future transit expansion (including planned metro links) which can boost property values over time.

Off-plan prices are generally lower than established centres like Downtown or Marina, offering upside as development completes.

3. Attractive Rental Yields

Meydan properties (especially luxury apartments and waterfront units) commonly deliver 6-8% rental yields, competitive with many other Dubai districts.

Growing tenant demand from professionals, families and expats fuels sustained rental interest – particularly for quality finishing and amenity-rich buildings.

4. Lifestyle & Mixed-Use Appeal

Integrating leisure, retail and residential space – with crystal lagoons, promenades, parks and community facilities – enhances livability and tenant appeal.

High-end mixed-use developments like Al Vista further embed commercial and residential synergy, adding value for investors targeting both income and capital growth.

⚠️ Cons (Risks & Considerations)

1. Limited Public Transport (Current)

Lack of direct metro/bus lines means residents often depend on private cars or ride-hailing – potentially reducing attractiveness for some tenant segments.

2. Ongoing Construction

Portions of Meydan (including Horizon) are still under development which may mean construction noise, unfinished infrastructure or temporary disruption – a short-term investor concern.

3. Higher Cost of Living & Services

Premium developments typically come with higher service charges, property costs and maintenance fees, which can compress net yields if not carefully accounted for.

4. Project-Specific Quality & Delivery Risks

Some off-plan and newly delivered projects in the broader Meydan area have experienced variable quality or developer-related delays, per local investor community feedback. This emphasizes the need to vet developers and project history carefully.

Investor Outlook Summary

| Factor | Outlook |

|---|---|

| Location Advantage | ⭐⭐⭐⭐ |

| Rental Yield | ⭐⭐⭐⭐ |

| Capital Growth Potential | ⭐⭐⭐⭐ |

| Liquidity & Demand | ⭐⭐⭐ |

| Risk Profile | Moderate (development & transport) |

In short: Meydan Horizon presents a balanced investment opportunity that combines strategic location, strong rental demand, and future-oriented master planning. It is especially appealing for medium-to-long-term investors (3-7+ years) who can capitalize on pending infrastructure and area maturation. Careful developer selection, due diligence, and pricing negotiation remain key to maximizing returns.