Commercial Property Dubai

best off-plan investment options

OFFICES, GRADE A-AAA

ENARA

PREMIUM class OFFICES grade AAA with private members club and a la carte services. Av.starting PRICE: 5'500 AED/sqft Handover: Q1 2028, PP: 70/30. Number of offices: 23.

LUMENA, Business Bay

Commercial Tower Grade AAA. Av.starting PRICE: 4'750 AED/sqft, SIZES from: 4'268 sqft. 91 offices (582'184 sqft) +44'605 sqft of Retail space +63'155 sqft of Amenities. 1'000+ parking slots. Next to Metro (!). HO:2030. PP:50/50

LUMENA ALTA, Business Bay

Commercial Tower Grade AAA. Av.starting PRICE: 5'000 AED/sqft, From 20M AED. Offices + Retail spaces + Amenities. 1'000+ parking slots. Close to Metro. HO: 2030. PP: 50/50

AHS Commercial tower DIFC

Av.starting PRICE 4'000 AED/sqft, SIZES from: 2'964 sqft for half-floor. Handover: Q4 2026, PP: 60/40. 69 levels, 500+ parking slots. Luxury Wellness Facilities (SPA, Gym, Cigar Lounge)

HQ by ROVE

commercial building in Business Bay - Offices with amenities. Av.starting PRICE: 4'250 AED/sqft. SIZES from:624 sqft. Handover: Q1 2029, PP: 50/50.

BURJ CAPITAL, Business Bay

Commercial tower Grade A++. Premium Shell & Core offices. Av.starting PRICE: 4'000 AED/sqft, SIZES from: 754 sqft. HO: Q4 2028. PP: 50/50. 3B+G+3P+26+R

OPUS

Ready Project in Business Bay. MIX USE: Retail, Hotel, Offices, 3 Residential floors. Price and availability on demand

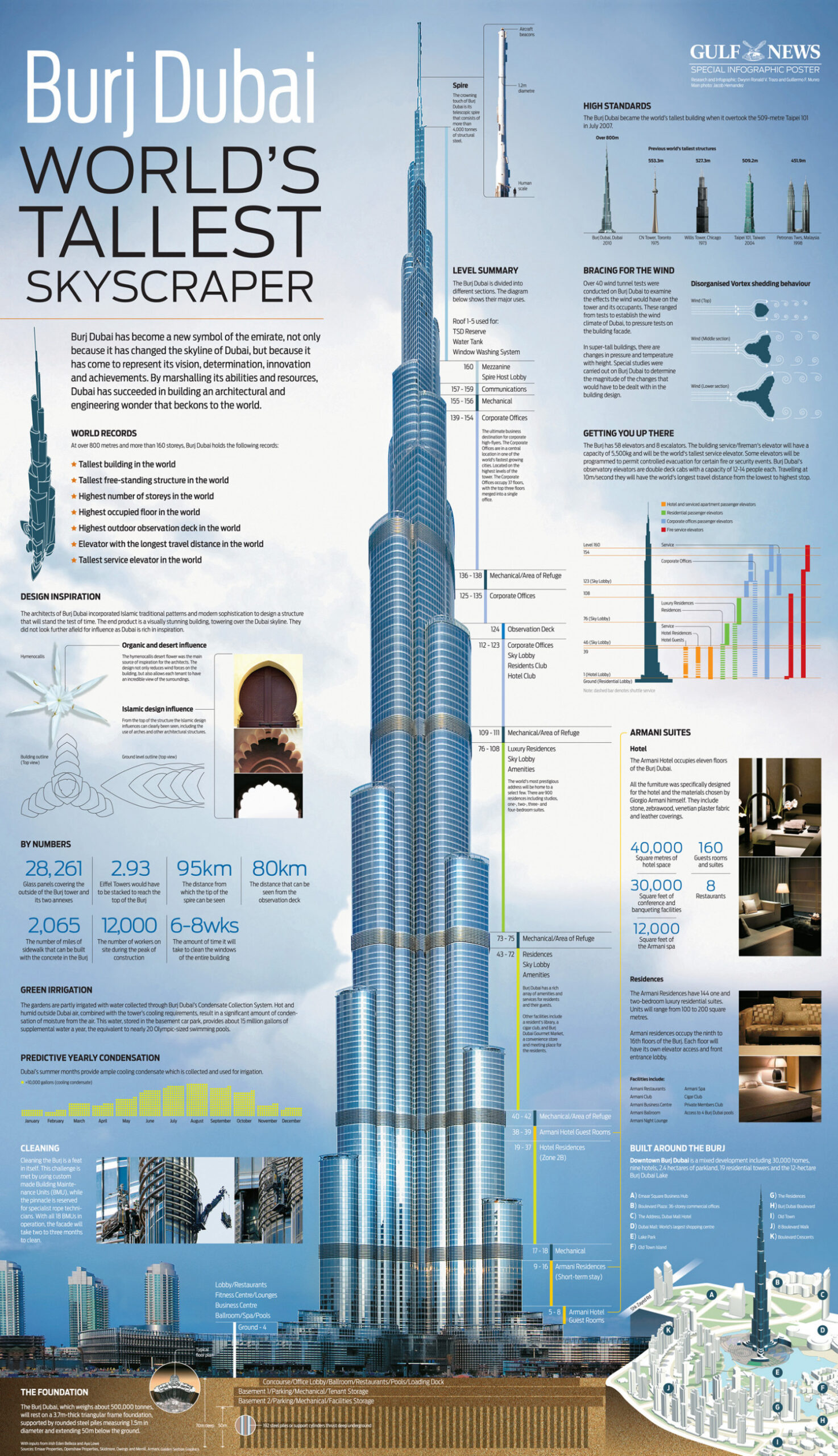

BURJ KHALIFA

Highest floors, open space offices, shell&core, from 6'000 sqft. Price on demand

BOULEVARD PLAZA

Ready project. Different options of Offices. Price on demand

31 ABOVE

MARITIME CITY - OFFICES. Av.starting PRICE: 4'000 AED/sqft, SIZES from: 2'200 sqft. Handover: Q1 2029, PP: 50/50.

Bureau Lamar @ Peninsula Business Bay

7 buildings (6 commercial + 1 wellness). Average PRICE: 6'000 AED/sqft. SIZEs from 6'200 sqft. Handover: Q1 2029. Payment Plan: 60/40

and many more in different areas...

Contact us by the links below!

Unlock Millions with UAE Commercial Real Estate in 2025

From sleek offices in Dubai to high-tech warehouses and vibrant mixed-use developments, the opportunities here are massive! Whether you’re new to investing or a seasoned pro, this video will show you how to cash in on the UAE’s booming economy. So, hit that subscribe button, grab a notebook, and let’s jump in!

Why the UAE? Picture this:

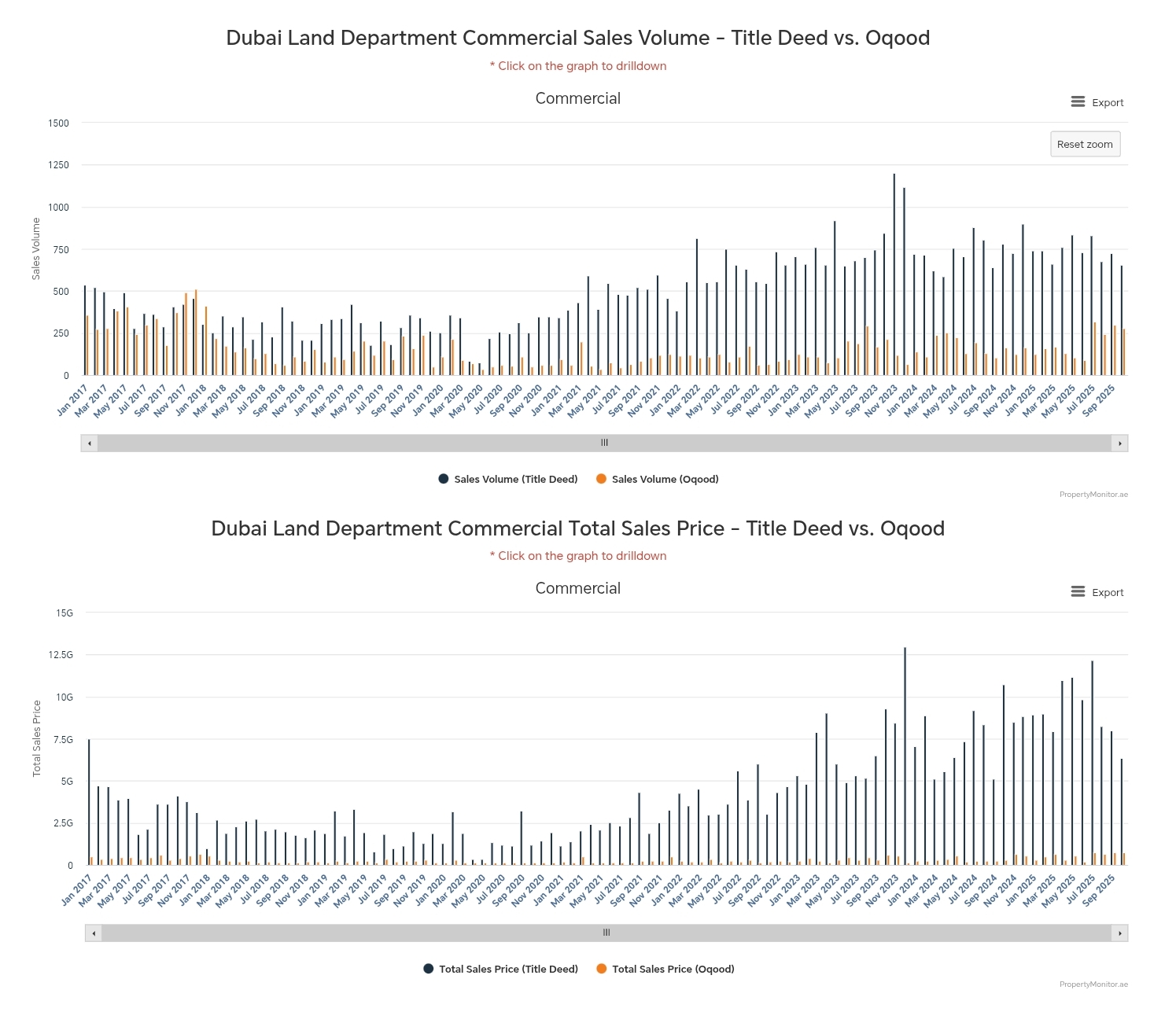

In 2024, Dubai alone recorded 761 billion of dirham in real estate deals – a 20% jump in value and 36% more transactions than 2023. The market’s set to grow 2.45% annually through 2029, hitting 0.76 trillion US dollars. That’s huge!

The UAE’s economy is rock-solid. Zero taxes on your profits, 100% foreign ownership in freehold areas, and its location connects Europe, Asia, and Africa, making it a global trade powerhouse. Plus, the UAE’s tourism is skyrocketing—think 121 billion of dirhams in revenue—and e-commerce is growing 15% a year with giants like Amazon and Noon.

Whether it’s offices, retail, or warehouses, the UAE’s commercial market is on fire, with rental yields of 7-11% crushing residential returns. Ready to get started? Here’s your game plan!

Pick High-Yield Hotspots.

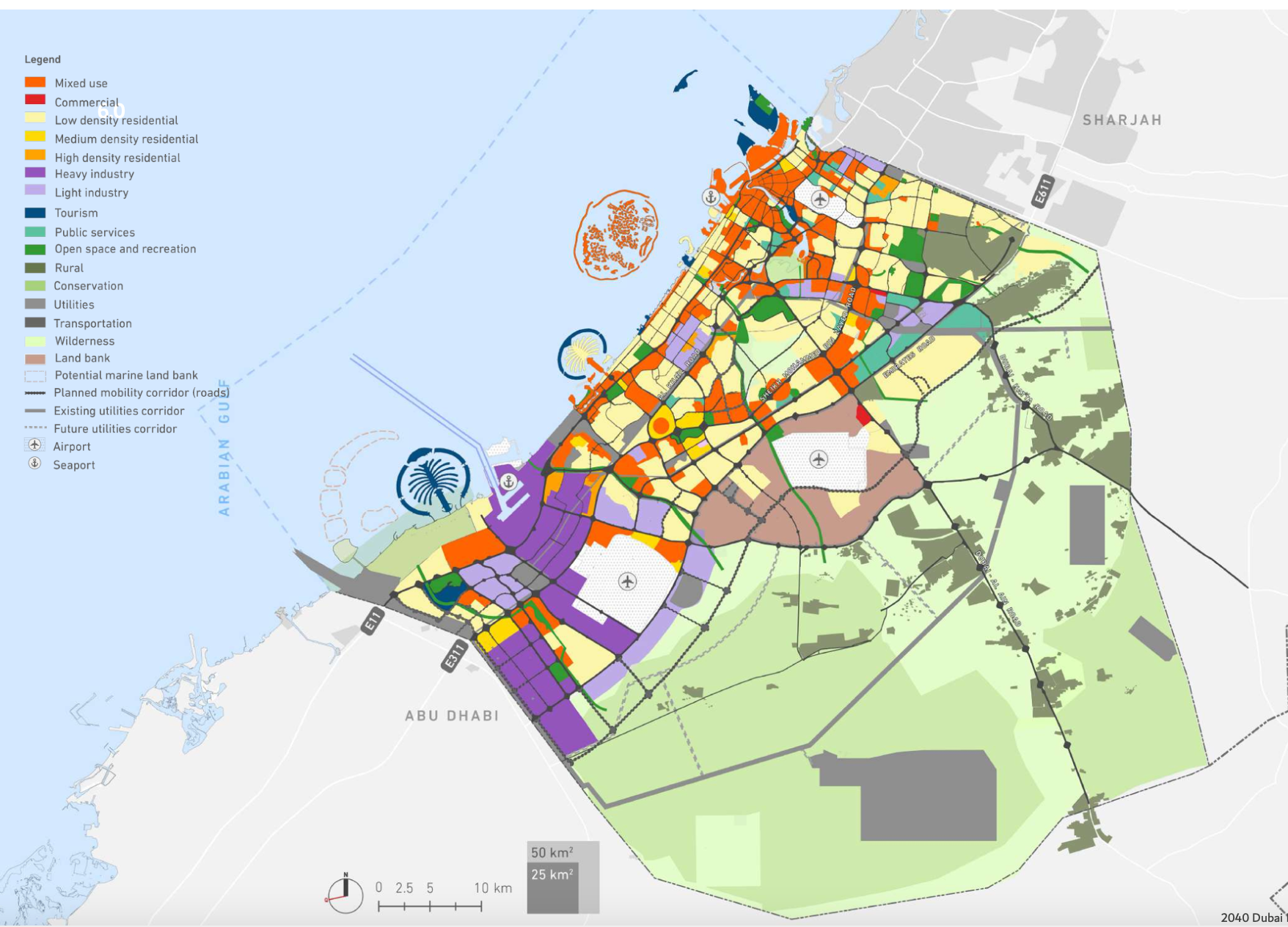

Let’s start with where to invest. Location is everything!

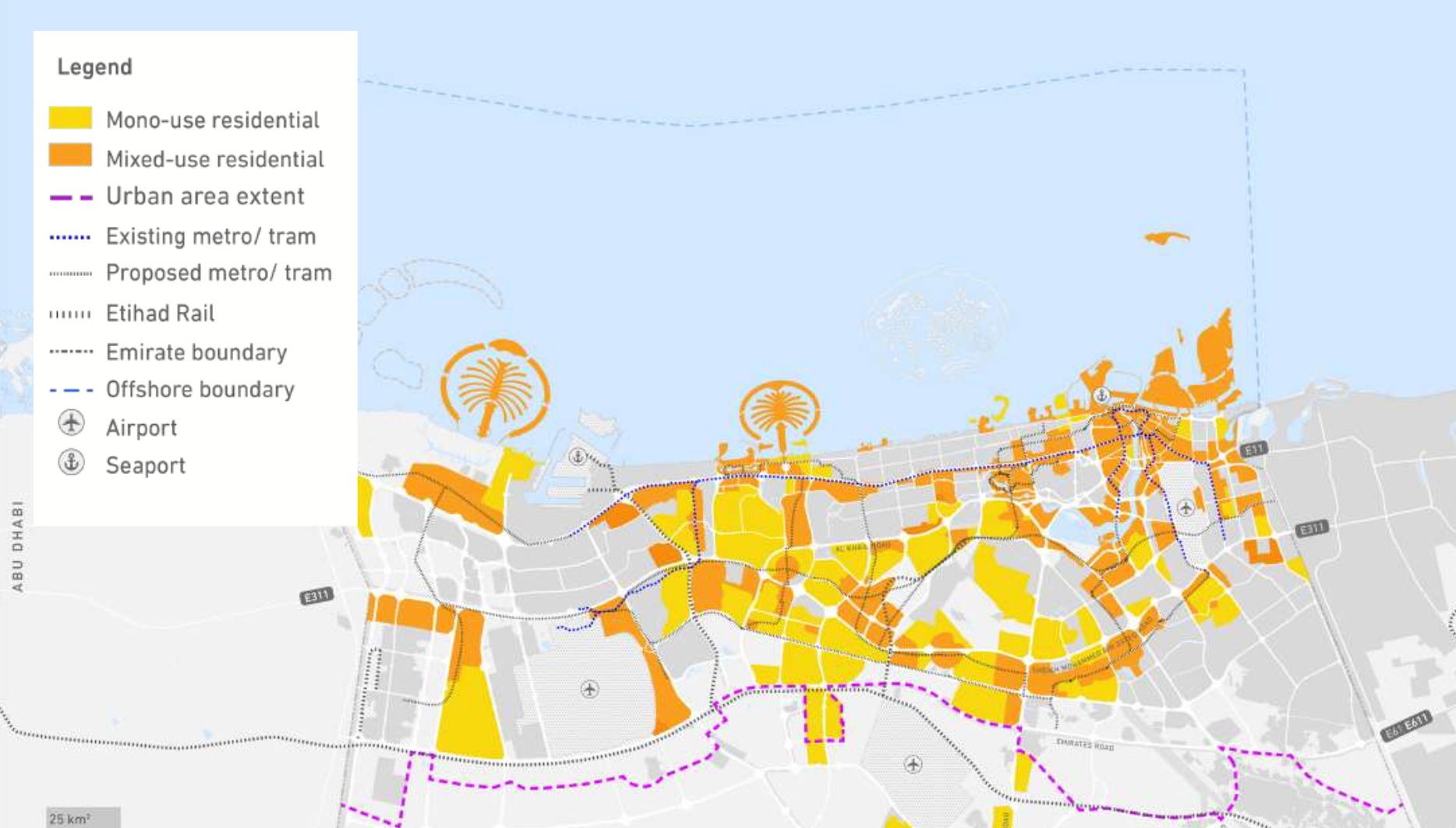

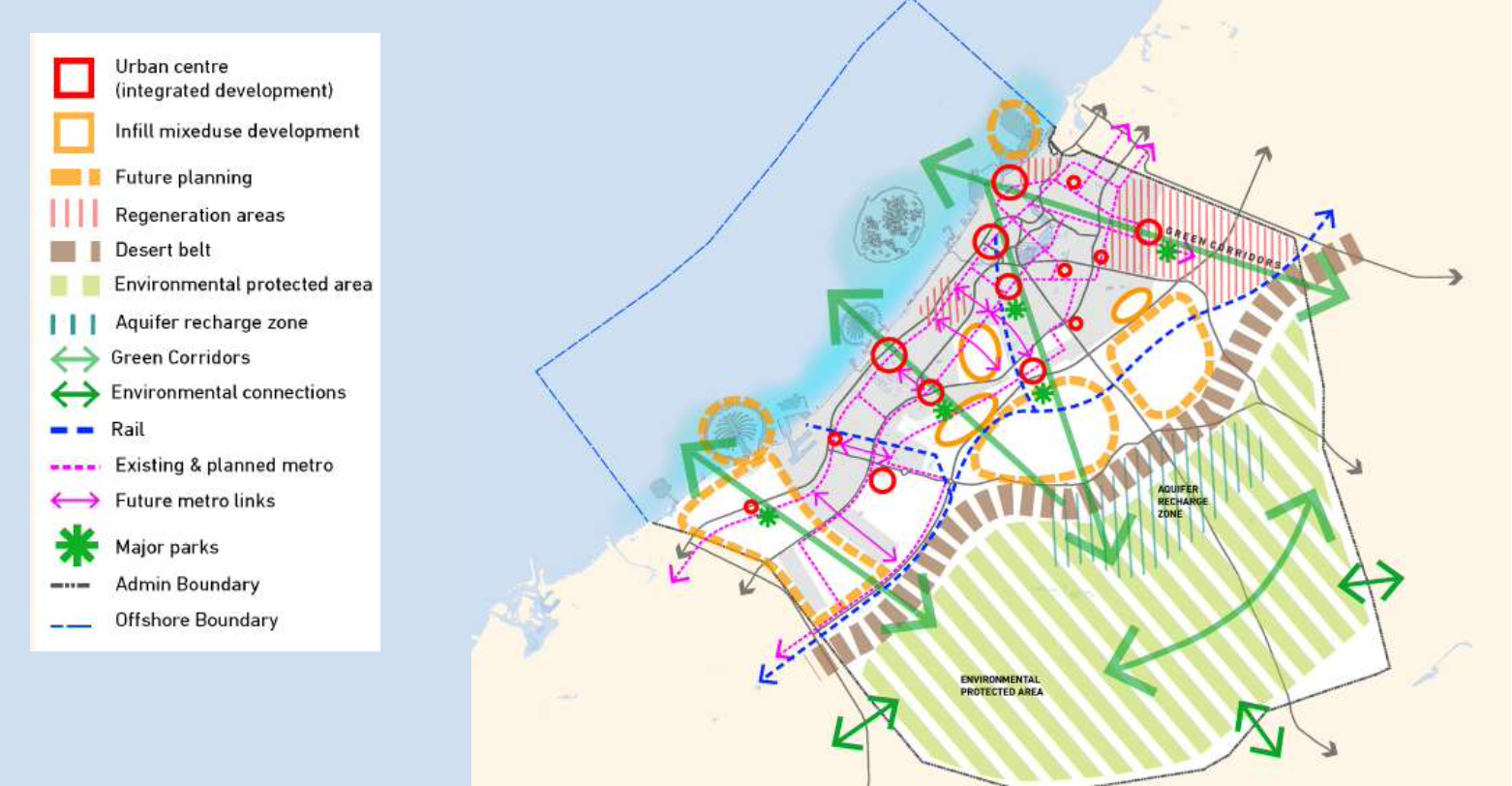

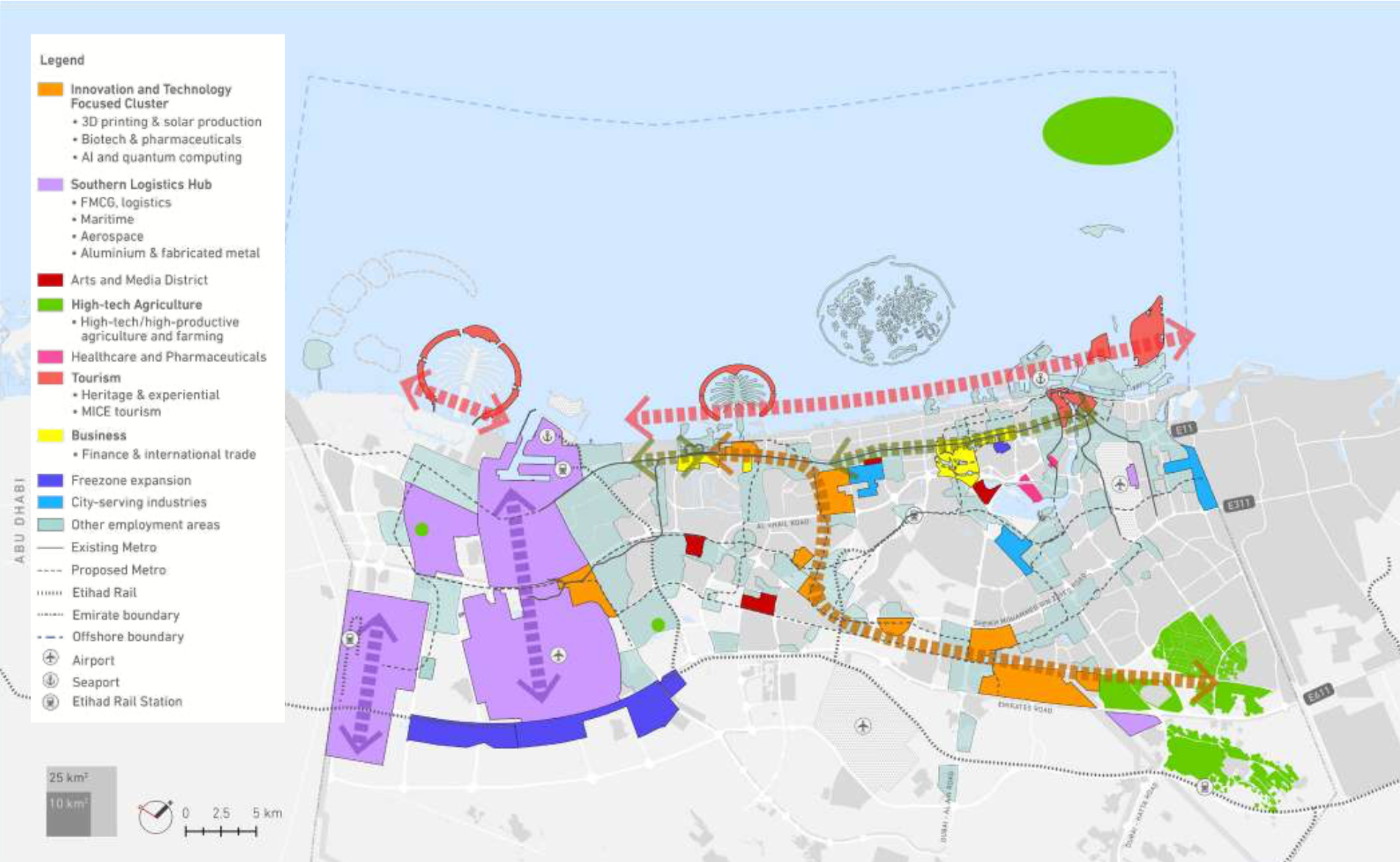

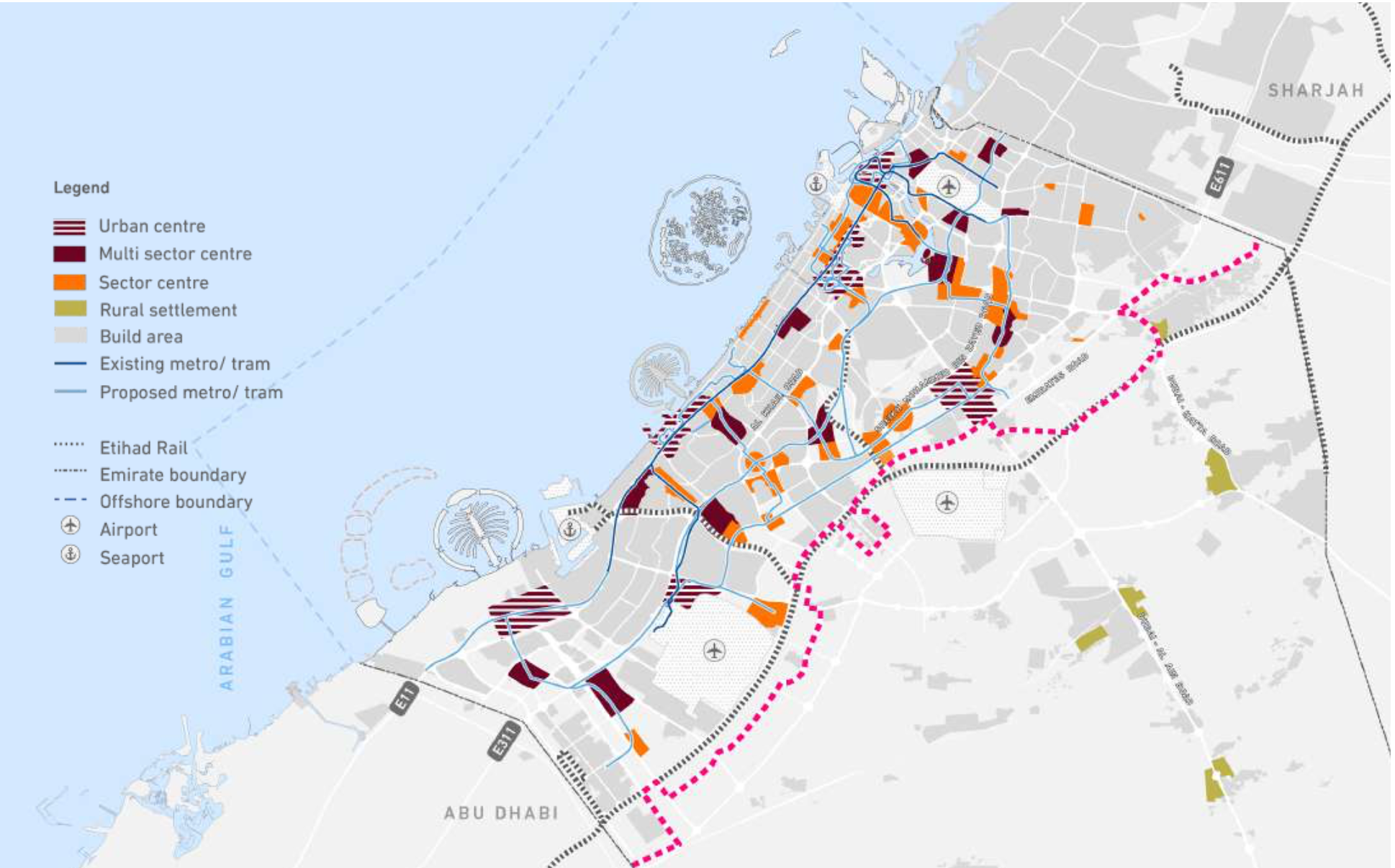

In Dubai, focus on prime spots like the Dubai International Financial Centre (DIFC), Business Bay, Jumeirah Lakes Towers, and Downtown Dubai.

These areas deliver 7-11% rental yields – way better than residential properties!

For example, an office in DIFC’s ICD Brookfield Place can earn you 10% a year with long-term leases , thanks to big-name tenants like banks and law firms.

Retail in Downtown Dubai, near the Burj Khalifa, thrives on tourist traffic.

In Abu Dhabi, Al Maryah Island and Al Reem Island offer great value and growing demand.

Freehold areas like DIFC and Abu Dhabi Global Market are a no-brainer – you get 100% ownership, tax breaks, and high occupancy rates.

So, go where the demand is!

Want growth? Check out emerging areas like Dubai South for warehouses or Al Reem Island for offices.

What types of properties should you buy?

Let’s break it down.

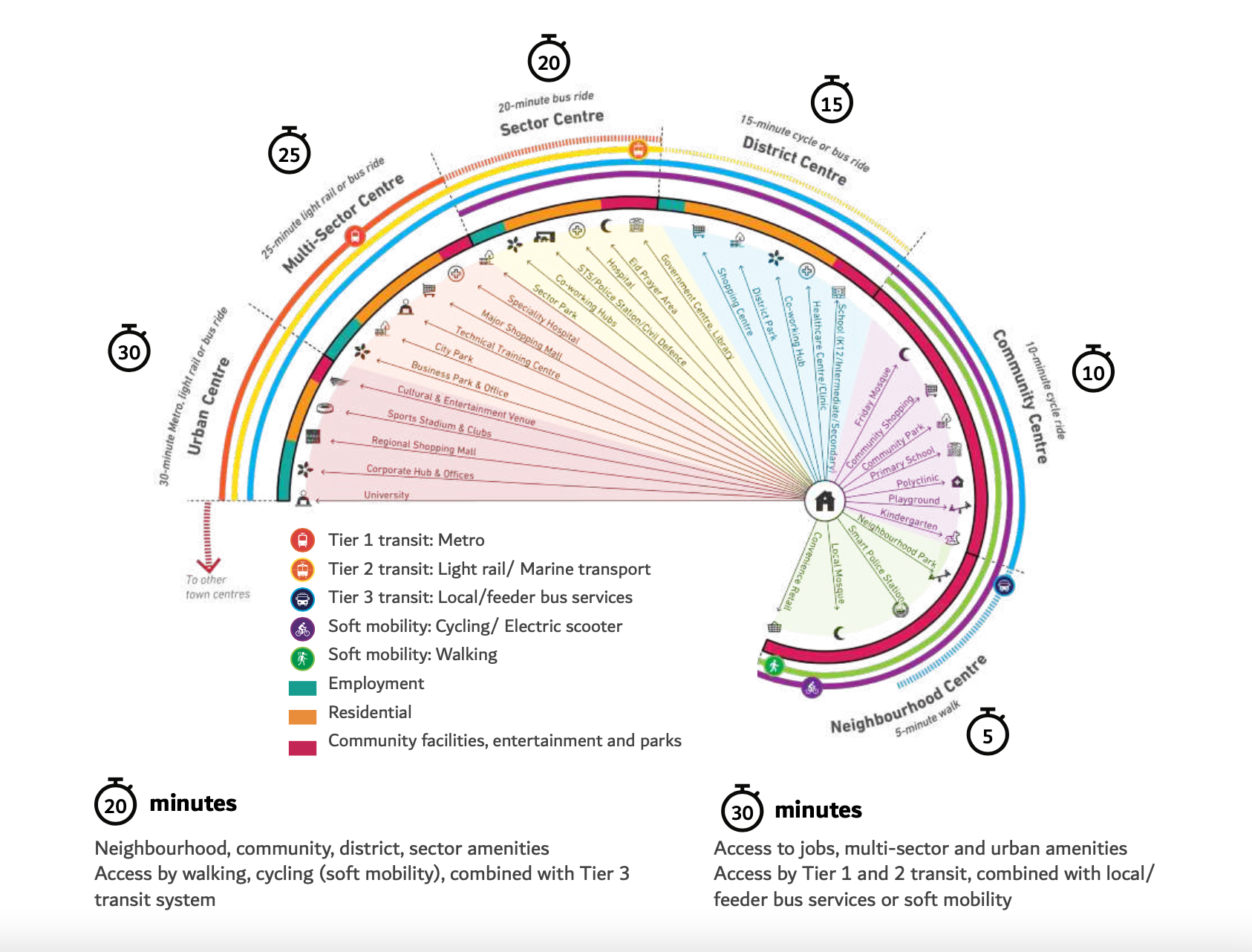

- Offices in DIFC or Business Bay are a safe bet, offering 8-10% yields and long-term leases from global corporations. Pay attention to upcoming Premium Grade AAA-class offices in top-tier buildings.

- Warehouses in Dubai South or Jebel Ali Free Zone are hot right now, with 7-8% yields driven by the e-commerce boom – think Amazon and Noon. These spots are near major airports and ports, ensuring steady demand.

- Mixed-use developments in Dubai Marina or Dubai Creek Harbour combine offices, retail, and leisure, attracting diverse tenants for higher returns.

- And don’t sleep on off-plan properties! Buying early in projects under construction can save you money upfront and deliver 10-20% gains when completed.

Diversification – is key to playing it smart.

Spread your investments across offices, retail, warehouses, and mixed-use properties to balance risk and reward.

- Mixed-use developments mix offices, retail, and leisure spaces, pulling in long-term tenants who love the vibe.

And don’t just stick to Dubai – Abu Dhabi’s Al Reem Island offers great pricing, and Ras Al Khaimah is emerging with its digital asset-focused free zone.

- By diversifying across emirates, you protect yourself from market dips and tap into unique growth opportunities, like Abu Dhabi’s Operation 300 Billion for industrial expansion.

- Tap into Free Zones and Government Perks. Here’s where the UAE shines: free zones like DIFC, DMCC and Abu Dhabi Global Market let you own 100% of your property — no local sponsor needed.

- Focus on office spaces or retail in high-demand areas for constant occupancy, or warehouses in Dubai South’s free zone near Al Maktoum Airport.

- Spread your investments across Dubai, Abu Dhabi, and even Ras Al Khaimah to balance risk and tap into each emirate’s unique growth.

With tourism booming, these properties can outperform traditional real estate.

Pro tip: Work with a DLD-registered agent to breeze through the legal stuff.

To maximize your profits, team up with experts. Our team at virt realty will support you with research of the best deals, navigate regulations, and avoid scams.

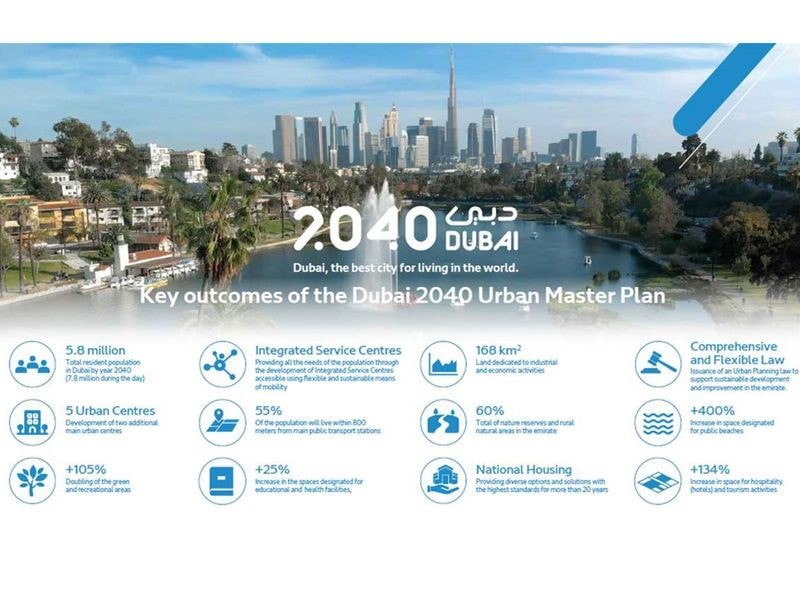

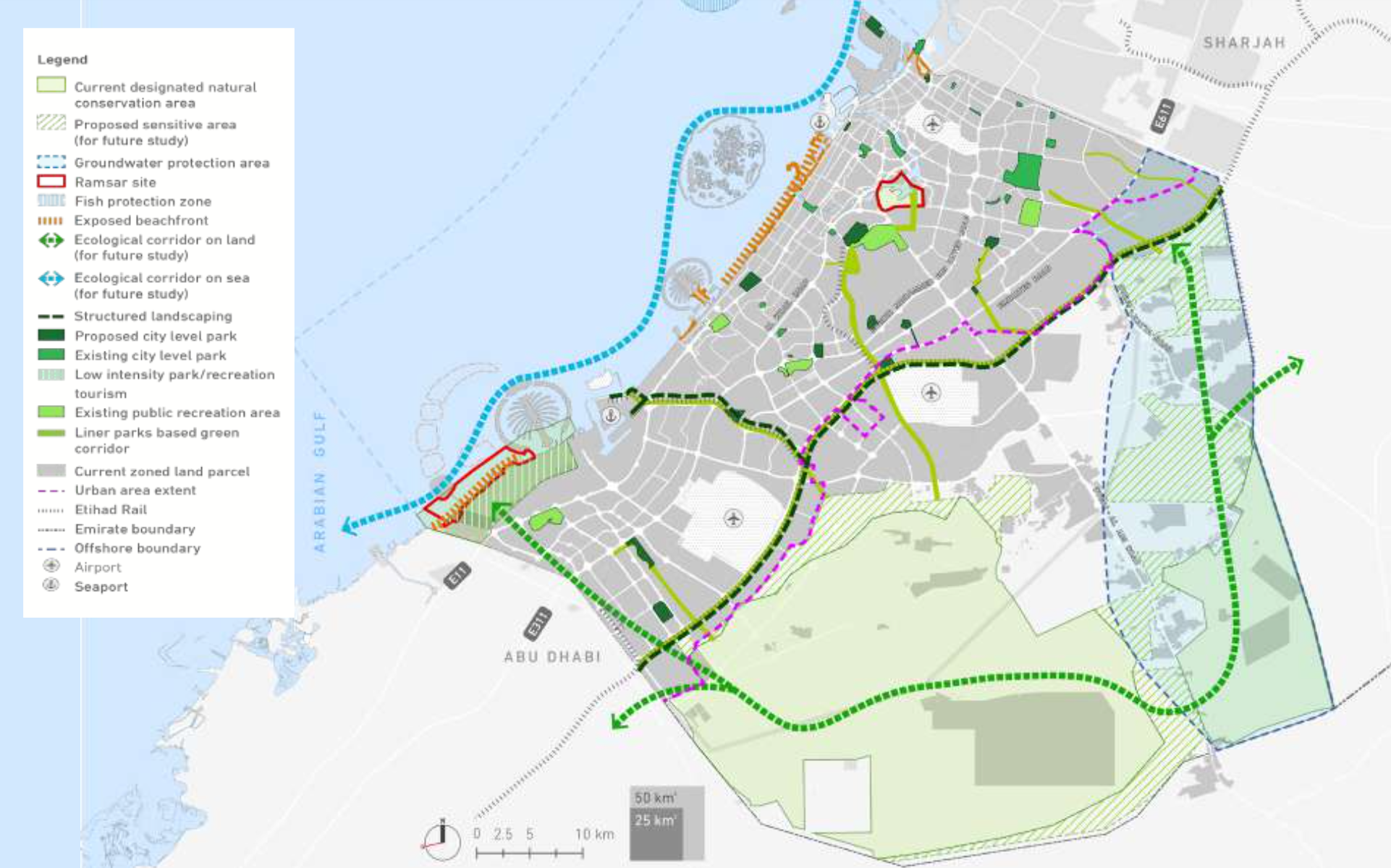

Want to future-proof your investment? Go green and smart!

Sustainability is huge in the UAE’s 2025 market. Tenants are paying premium rents for eco-friendly buildings with LEED certifications or smart tech like automated systems. Think Masdar City in Abu-Dhabi, Expo City Dubai or Dubai Sustainable City for cutting-edge properties.

These gems align with the UAE’s goal of 30% clean energy by 2030.

Smart properties with tech like automated systems and IoT are also in demand – they save costs and attract tech-savvy tenants, boosting your property’s value.

The UAE government makes investing even sweeter.

With the Golden Visa,

at 2 million dirham investment – about 540,000 US dollars – you could get a 10-year residency visa.

No property taxes, and free zones like DIFC offer tax exemptions on income.

Plus, the UAE’s removal from the FATF Grey List shows it’s a safe and transparent place to invest.

These government perks can seriously boost your profits!

Cash In on Warehouses

The e-commerce boom is driving demand for logistics properties in Dubai South and Jebel Ali Free Zone.

These spots offer 7-8% yields and are near global trade hubs like Jebel Ali Port.

A warehouse in Dubai South could be your ticket to stable cash flow and 10-20% price growth in 2025.

It’s less volatile than offices or retail, making it a smart play for steady returns.

So, what are our top picks for mid-2025?

- Number one: Offices in DIFC or Business Bay for steady 8-10% yields and growth.

- Number two: Warehouses in Dubai South for e-commerce-driven returns.

- Number three: Off-plan mixed-use in waterfront communities for big capital gains. These are your ticket to success!

Now, what’s the catch?

The pros are incredible: high yields, tax-free profits, and government perks like the Golden Visa. The UAE’s market is projected to grow 5-7% yet in 2025, and places like DIFC and Dubai South are low-risk bets.

But, there are risks:

Global market shifts could slow demand, some areas face oversupply, and commercial properties need bigger budgets than residential ones.

Tenant reliability matters, too. Stick with us, and we’ll guide you through every step.

The UAE is a global powerhouse, with a thriving economy, tourism on fire, and e-commerce soaring. Whether it’s a sleek office in DIFC, a retail space in Downtown Dubai, or a warehouse in Dubai South, you’re investing in a market with unmatched stability and growth.

Plus, with data-driven tools and our expert advice, you’ll stay ahead of the curve. This is your chance to build wealth in one of the world’s most investor-friendly countries.

Ready to jump in? Here’s how to start.

- Step one: Do your due diligence to avoid overpaying or scams, to find deals and track trends.

- Step two: Team up with DLD-registered agents – they’ll guide you through the market and legal stuff, including AML compliance to avoid hefty fines.

- Step three: Explore financing – banks offer up to 80% loans for commercial properties, and developers have flexible payment plans for off-plan projects.

We can help you every step of the way!

The UAE’s commercial real estate market in mid-2025 is your chance to build wealth in a thriving, investor-friendly economy.

With yields up to 11%, no taxes, and the Golden Visa, the Sky’s the limit!

Don’t go it alone – at VIRT REALTY, we specialize in finding high-yield properties, from offices to warehouses.