AL BARARI & WILDS

Oasis of Tranquility in Lush Greenery

Al Barari is a unique established ready residential community in Dubai that stands out for its commitment to sustainability and its focus on creating a serene and green living environment. Discover a unique residential community where lush greenery, luxurious living, and unparalleled serenity blend seamlessly.

AL BARARI:

VILLA

TOWNHOUSE

APARTMENTS

Al Barari — quick investor brief

What it is (location & character)

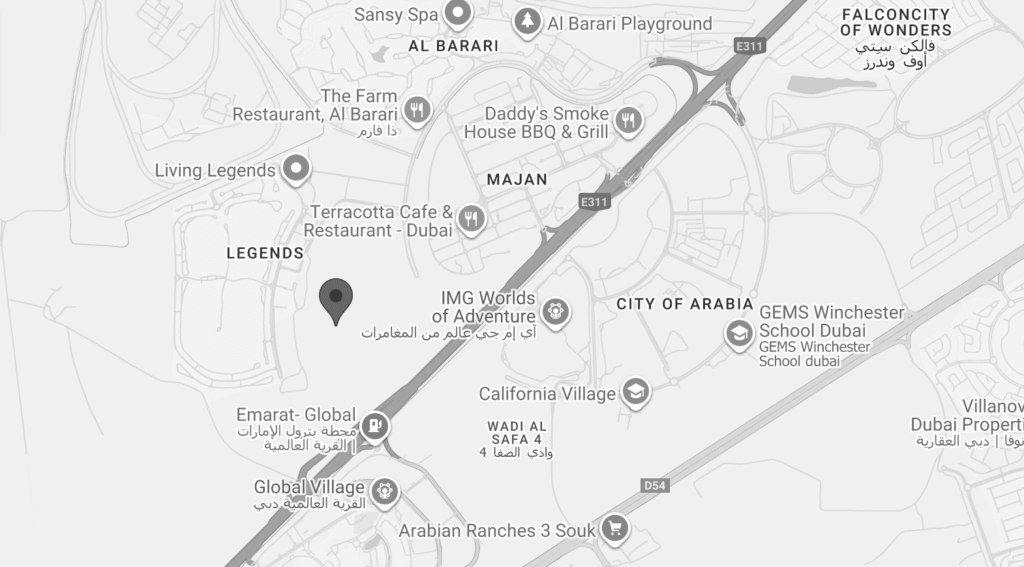

Al Barari is a luxury, low-density gated community in Nad Al Sheba / near Sheikh Mohammed bin Zayed Road, built around extensive botanical gardens, lakes and wellness-focused facilities. It’s marketed as an “eco-luxury” enclave with villas, townhouses and a small collection of apartments.

Pros

Unique selling point — nature & exclusivity: one of Dubai’s most established “green” luxury addresses with large private plots, mature landscaping and water features that deliver strong lifestyle differentiation.

Proven premium market: scarcity and brand positioning support resilience in the high-end segment — attractive to HNW buyers and owner-occupiers seeking privacy.

Amenities & F&B draw: on-site hospitality (The Farm), wellness/spa, boutique retail and curated dining increase end-user appeal and support lettability for premium tenants.

Cons / Risks

Very high entry prices & limited buyer pool: ultra-luxury positioning reduces liquidity; resale windows can be long in weaker markets.

Maintenance / service charges: high service and landscaping costs are typical — factor into net yields and cashflow stress tests.

Suburban commute trade-off: more tranquil but further from some central business districts — acceptable for families, less so for tenants wanting ultra-short commutes.

Appreciation & yield outlook

Long-term cap-growth story: driven by scarcity, strong brand and unique product. Expect steady appreciationover a 5–10 year hold if Dubai luxury demand remains healthy. Rental yields are modest to moderate for villas (lower than central apartments), but premium rents are possible for turnkey, well-managed properties.

Tactical recommendation

Best for buy-and-hold investors or HNW end-users seeking a trophy home. Prioritise proven resale units (well-positioned villas near gardens/amenities).

Always stress test for service charges and operating costs.

The Wilds (by Aldar) — quick investor brief

Location & character:

The Wilds is a newly launched, nature-led villa community by Aldar in Dubailand / Wadi Al Safa area (along Sheikh Mohammed bin Zayed Road, near Global Village). Launched recently as Aldar’s first Dubai residential project, it targets low-density, family-oriented living with sustainability design cues. Handover phases extend into the later 2020s.

Pros

Strong regional developer with fresh product: Aldar brings a trusted regional track record; a new product entering a demand segment for family villas may capture buyers priced out of older gated luxury projects.

Nature & family focus: planned parks, walkways and child-friendly amenities are attractive for long-term family tenants and owner-occupiers.

Competitive pricing window (early phases): as a newer project in Dubailand, early buyers may access comparatively better entry pricing vs established luxury enclaves.

Cons / Risks

New-project / delivery risk & time horizon: as a recent launch, parts of the community are at planning/construction stage — investors should factor handover timelines and infrastructure completion risk.

Submarket competition (Dubailand): many villa projects target the same suburban family buyer; differentiation (design, finish, community activation) will determine resale performance.

Secondary market uncertainty: liquidity will depend on how Aldar positions the product, the finish quality delivered, and broader market appetite for Dubailand villas at the time of resale.

Appreciation & yield outlook

Medium-term upside (5–8 years) if execution is strong: Aldar’s brand + well-priced early availability could produce healthy capital gains as project phases complete and community amenities open. Rental yields for family villas are moderate; focus on fully furnished, professionally managed leases to maximise occupancy.

Tactical recommendation

Good fit for investors willing to accept a development timeline (early-phase purchases). Best approached as a medium-term buy-and-hold play where early buyers benefit from price appreciation as delivery progresses. Verify exact handover schedules, payment plans and clubhouse/amenity delivery guarantees.

Short comparative takeaway

Al Barari = mature, ultra-luxury, lifestyle trophy asset → safer on brand but expensive & less liquid.

The Wilds = new, nature-led Aldar product in Dubailand → better early-entry pricing and growth runway if the project executes, but requires comfort with construction/timing risk.