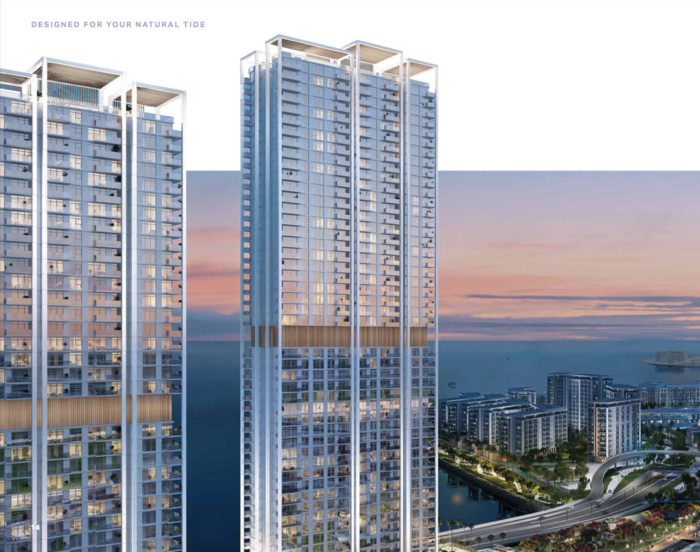

BLUEWATERS

Dubais Waterfront Oasis

Unique island, a vibrant waterfront destination. Enjoy iconic attractions like the Ain Dubai observation wheel, luxury residences with stunning views, and a lively mix of dining and entertainment options.

OPTIONS:

BLUEWATER BAY

Under construction. Available on Secondary Market. Handover: Q4 2028, PP: 70/30

APARTMENTS

TOWNHOUSE

What works in favour of Bluewaters Island:

• Prime location + island-style, waterfront lifestyle

The Island sits just off the coast of Jumeirah Beach Residence (JBR), making it extremely accessible to Dubai Marina, Palm Jumeirah, and major corridors.

The community combines urban convenience and resort-style living: apartments/townhouses with sea, skyline or water-views, floor-to-ceiling windows, modern finishes and a lifestyle comparable to vacation living.

• Strong amenities, entertainment, retail and social infrastructure

Bluewaters is more than a residential community. It houses a major entertainment, retail and dining infrastructure, including waterfront promenades, beach clubs (e.g. private beach / “beach-club vibe”), restaurants, boutique shops, cafés, and leisure venues.

Iconic landmarks and attractions: the mega observation wheel Ain Dubai is located on the island, which bolsters tourist demand and prominence of the community.

For residents: modern apartments and townhouses (1- to 4-bedrooms, some townhouses/penthouses) with high-end finishes, open layouts, quality appliances, good natural light – attractive for both owner-occupiers and premium tenants.

• Limited supply → exclusivity & strong demand pressure

Bluewaters Island has a relatively limited number of residential units (mid-rise towers + a finite number of townhouses / penthouses). Tthis scarcity tends to support value retention and long-term price strength.

Because of the above + strong lifestyle appeal + waterfront location, the community tends to attract affluent buyers/renters: expats, professionals, families seeking premium accommodation, or investors wanting high-end rental/holiday-rental yields.

• Good rental & resale potential compared to many alternatives

Rental yields are typically higher than many non-waterfront areas: yields for apartments on Bluewaters are often quoted around 6–8%, which is competitive for the quality and location.

For investors focusing on short-term or holiday-style rentals (tourists or short-stay professionals), the attractions, beach-club vibe and tourist-draw of the island increase occupancy potential.

Potential drawbacks / Risks:

• High entry costs and premium pricing

As a luxury waterfront, high-demand community, purchase prices and rents are at the upper end. This raises the barrier of entry and limits pool of buyers/renters to high-net-worth individuals or premium tenants.

Service charges, maintenance and general cost of living (groceries, utilities, lifestyle amenities) tend to be higher than many inland or non-luxury communities.

• Supply is limited and units go fast — less flexibility & lower liquidity sometimes

Limited number of units means when you try to buy you may face competition. Also, difficulty finding matching resale units may affect liquidity.

Because of exclusivity and demand by both investors and end-users, resale prices tend to remain high, which can limit upside for price appreciation compared with emerging communities where discounts or growth potential might be larger.

• Tourist & visitor pressure — possible crowding, noise, and less “quiet residential” feel

As a major leisure and entertainment hub with beach clubs, restaurants, tourist attractions, the island can get busy, especially during weekends/holidays, which may reduce appeal for those seeking calm, serene living.

For families or long-term residents, lack of in-island schools or perhaps limited full-scale community infrastructure compared to large master-planned residential communities may be a downside (though nearby mainland areas cover many amenities).

Investment & Appreciation Outlook for Bluewaters Island

Because of its limited supply + high desirability + prime waterfront location + appeal to affluent tenants/owners, Bluewaters is well-positioned for steady long-term value preservation and potentially capital appreciation, especially if Dubai’s luxury real estate demand remains strong.

Rental yields ~6-8% (or more for short-term rentals) make it appealing for investors seeking regular income, especially if they manage the property professionally and target premium tenants or holiday-rental demand.

Given its high-end segment, the asset behaves more like a premium lifestyle/residential trophy investment rather than a high-volume/high-yield project. Good for wealth preservation, brand-value real estate in your portfolio.

Who Bluewaters Island is Best For (Investor / Buyer Types)

High-net-worth individuals / families seeking resort-style, waterfront living close to Dubai’s leisure and business hubs.

Investors targeting premium rentals or short-term / holiday rentals, neutral to slightly higher risk in exchange for higher yields and good occupancy.

Buyers looking for prestige and long-term value retention rather than aggressive flipping – a “trophy asset” in their portfolio.

Those willing to pay for luxury, convenience and lifestyle amenities, and comfortable with higher purchase price and ongoing maintenance costs.

Our Advise

Bluewaters Island stands out as one of Dubai’s most prestigious waterfront residential investments: combining location, lifestyle, scarcity and rental demand. For investors aiming for steady income + long-term value + premium asset in portfolio, it’s a compelling choice.

The trade-off is the high capital requirement and somewhat limited upside compared with more “growth-oriented” but riskier off-plan or emerging communities.