GHANTOOT

Ghantoot is an emerging premium waterfront/resort-style corridor on the Abu Dhabi–Dubai axis offering beachfront villas, gated communities and branded off-plan projects – attractive to investors seeking resort-style coastal product with good road connectivity to Dubai and Abu Dhabi, plus potential upside from new developer launches.

✅ Key strengths & investment merits

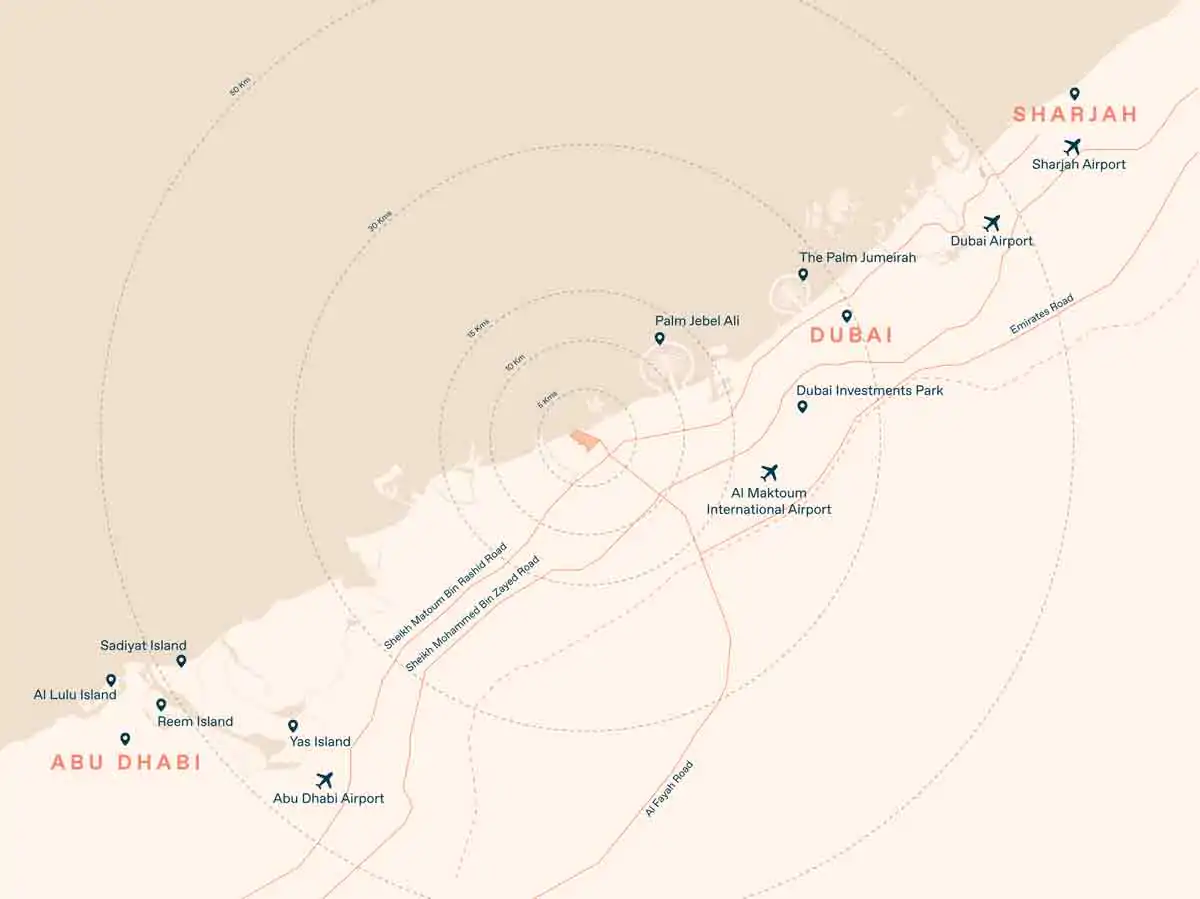

Strategic location between Abu Dhabi and Dubai – easy highway access (E11) puts Ghantoot within ~40–60 minutes of both city centres depending on origin, making it appealing to buyers/tenants who want a quieter coastal lifestyle while keeping access to either city. This dual-city catchment is a practical selling point.

Resort & marina assets — lifestyle appeal

The area hosts Ghantoot Marina, private beaches and resort operations that create a genuine coastal-resort feel (beach access, water-sports and marina services). This supports premium pricing for beachfront villas and short-let holiday product.

Active developer pipeline — branded & villa projects

Multiple prominent developers (IMKAN, ORA, Ohana and others) have active off-plan and completed projects in Ghantoot — from branded beachfront residences (Jacob & Co. Beachfront Living by Ohana) to villa communities such as Al Jurf Gardens — giving investors a mix of off-plan entry options and completed stock.

Product mix focused on villas & beachfront plots

Unlike dense-apartment markets, Ghantoot offers 2–7 bedroom villas, townhouses and exclusive plots — attractive to family buyers, holiday-let owners and HNW clients seeking private outdoor space and beach access. Scarcity of comparable beachfront stock between Abu Dhabi and Dubai supports premium positioning.

Increasing marketing narrative for exclusivity

Recent market commentary is positioning Ghantoot as a luxury coastal enclave — useful for storytelling to end-users and for justifying premium pricing to investors focused on lifestyle/resort assets.

⚠️ Main risks & considerations

Market maturity & liquidity

Ghantoot is still developing its reputation compared with well-established Abu Dhabi waterfronts (Saadiyat, Yas). For ultra-luxury villas, the buyer pool is smaller and resale can take longer – expect a medium-to-long hold horizon.

Transport & services dependency

While road links are good, the area relies on private transport; mass infrastructure, retail and medical services are less dense than city centres. That affects rental appeal for long-term tenants (families/expats) versus holiday-let or owner-occupiers.

Project concentration & execution risk

Value depends heavily on individual developers and specific project delivery (amenities, beach access, completion timelines). Off-plan buyers must evaluate developer track record, escrow arrangements and delivery milestones.

Regulatory / tenure checks

Confirm whether specific sub-communities are freehold for international buyers or have other tenure/ownership conditions; this impacts financing, mortgage availability and resale market.

🎯 Tactical investment angles

Buy & Hold (capital appreciation 4–7+ years): Acquire off-plan villa or plot early in a headline launch (favourable payment plan) and hold until community amenities mature and market recognition grows. Best for HNWIs and bespoke villa projects.

Lifestyle holiday-let (short/seasonal income): Position beachfront villas for holiday rentals and high-season yields. Requires local operator/management and compliance with short-let regulations; yields can outpace long-term rents but are season-sensitive.

Speculative flip (select off-plan units): For investors with appetite for development risk, selectively flipping well-located units (first-row beach, branded product) can capture launch-to-handover appreciation, only if developer pedigree and demand indicators are strong.

Portfolio diversification (smaller ticket): Consider lower-maintenance townhouses or completed villas with near-term rental profile to balance risk for investors not wanting a bespoke-build commitment.

📋 Quick SWOT

| Strengths | Weaknesses |

|---|---|

| Coastal/resort product, marina & beach access. | Less established market than Abu Dhabi’s prime islands. |

| Developer pipeline (branded launches, villa communities). | Smaller buyer pool for ultra-luxury villas → potential liquidity lag. |

| Dual catchment (Abu Dhabi + Dubai). | Dependent on private transport & local services. |

| Opportunities | Threats |

|---|---|

| First-wave buyers can capture meaningful appreciation. | Project delays / developer execution risk. |

| Holiday-let premium in peak seasons. | Macro shock, travel downturn or oversupply of villa stock. |

🔮 Short recommendation

Ghantoot is attractive if you value privacy, direct beach/marina access and don’t need immediate urban amenities. Take in consideration a plot/villa purchase with a 4–7+ year horizon and an experienced local build/management partner.