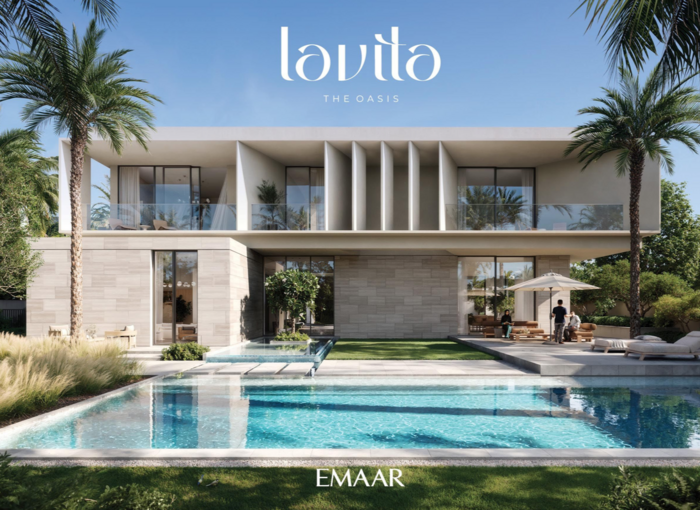

THE OASIS

HIDDEN PARADISE

Luxury living at The Oasis, by lagoons, where modern architecture meets lush landscapes, creating a harmonious blend of sophistication and tranquility. Discover the unique lifestyle offered by this thriving community.

LATEST LAUNCHES

MIRAGE

Sold out. Available only on Secondary Market. Handover: Q2 2028, PP: 90/10.

PALMIERA

Sold out. Available only on Secondary Market. Handover: Q3 2028, PP: 90/10.

ADDRESS GRAND by NSHAMA

Sold out. Available only on Secondary Market. Handover: Q1 2029, PP: 90/10.

✅ What works in favor of The Oasis

• Premium master-planned lifestyle & strong developer brand

The Oasis is developed by Emaar Properties — a leading name behind high-end Dubai communities.

It’s built as a low-density villa community: about 3,100 villas over roughly 8.5 million sq ft, giving spacious plots, privacy, and a sense of exclusivity.

The design emphasises resort-style living: waterfronts, lagoons, landscaped green spaces, water features — offering a lifestyle close to a private resort rather than just a housing development.

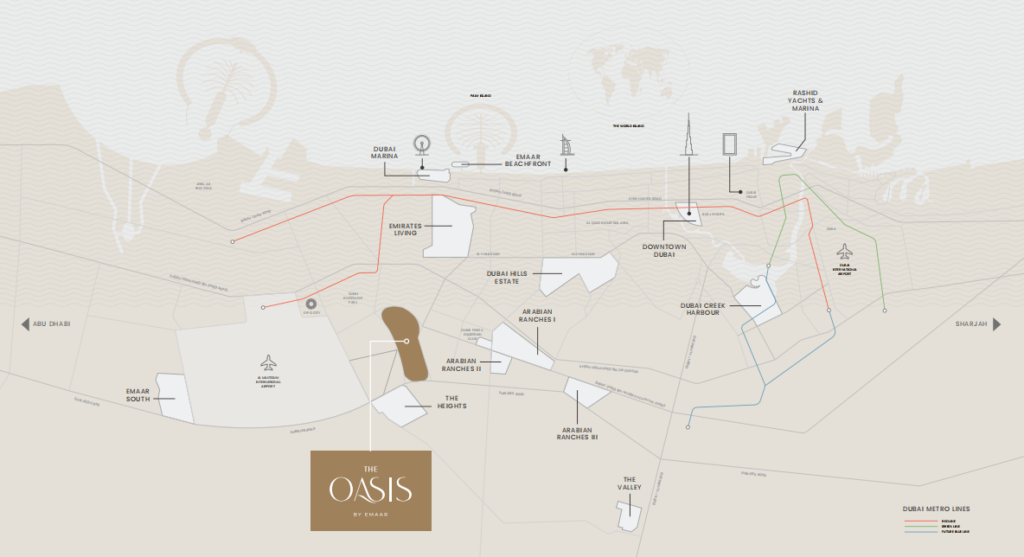

• Strategic location & connectivity

The Oasis is positioned in southeast Dubai along major corridors (near Dubai–Al Ain Road and other highways), providing reasonable commute times: e.g. 15 min to Downtown Dubai, 20–25 min to other major hubs.

This balances a tranquil, green-living environment with access to the city’s business, leisure, and transport hubs — appealing to both families and professionals.

• Long-term value & investment potential

Because of its limited villa supply + low density, The Oasis may benefit from scarcity — a factor that tends to support capital appreciation over time.

For investors interested in rental yield: early reports / marketing materials suggest potential rental yields circa 5–6% for 4-bedroom villas.

The project’s expansion (landscape, amenities, infrastructure) has been publicly announced — which may reinforce long-term value once fully delivered.

• Lifestyle appeal — for owner-occupiers or high-end tenants

The community is clearly designed with quality of life in mind: green parks, lagoons, water-feature waterfronts, jogging/cycling tracks, likely good privacy and security — which can attract premium renters or family buyers.

Villas across various configurations (4, 5, 6 bedrooms) with generous plot sizes — offering flexibility depending on buyer’s budget and living needs.

the-oasis-by-emaar.com

⚠️ Potential drawbacks / Risks to Consider

• High entry price — expensive segment

As a luxury, branded, low-density villa community, prices at The Oasis start high: 4-bedroom villas reportedly start from ~AED 13.16 M, with 5- and 6-bedroom villas/mansions substantially more.

This may limit pool of buyers / tenants to high-net-worth individuals — which is fine if demand holds, but reduces flexibility versus more mid-range properties.

• “Project completion / delivery” risk & patience required

The handover timeline for many villas (or certain phases) is not immediate (many sources mention future completion).

If you’re investing for short-term gains, there may be a waiting period until infrastructure, amenities, and full community features are realized — which influences rental demand and resale desirability.

• Luxury segment sensitivity & liquidity risk

Luxury villas in Dubai tend to be more sensitive to broader economic conditions, investor sentiment, and buyer demand fluctuations — which can affect time to resale or rental occupancy, especially if supply of luxury villas increases elsewhere.

Given high capital commitment, financing costs or cash-flow constraints (if financed) may be larger than with more modest properties.

• Buyer expectations are high — quality & delivery standards matter

For a premium product like this, delivery quality, finishing, community infrastructure and amenity execution must match expectations to preserve value. Under-delivery (delays, lower-than-promised amenities) can hurt resale/rental demand.

Long-term ROI relies on Emaar delivering on its masterplan and supporting infrastructure — which, while likely given Emaar’s reputation, remains a variable until full handover.

📈 Investment Outlook: Appreciation & Liquidity Potential

The combination of limited supply + master-planned exclusivity + premium branding (Emaar) positions The Oasis as a long-term value asset. Over 5–10 years, as Dubai grows and demand for luxury villas remains high, villas here may appreciate significantly.

Early investor messaging suggests rental yield in the 5–6% range (for 4-bed villas), which — combined with capital appreciation — could make for a solid total return for buy-and-hold investors.

For resale: if market conditions are favorable and Emaar completes the development as planned — the exclusivity and lifestyle appeal could make villas attractive to both wealthy expats seeking family homes and investors looking for trophy assets.

🏡 Who is The Oasis by Emaar Best Suited For

Investors with long-term horizon (5–10+ years), aiming for capital growth + rental yield rather than quick flips.

High-net-worth individuals or families seeking luxury, space, privacy and quality lifestyle — especially attractive to expatriates or professionals working in central Dubai but valuing tranquillity.

Buyers looking for prestigious, branded real estate (a “trophy asset”) with strong developer backing and master-plan vision. Investors willing to navigate illiquidity risk (given high price point and lower volume of buyers) in exchange for exclusivity and potential upside over time.

✅ Conclusion

The Oasis by Emaar is among the top-tier villa-community investments in Dubai right now — combining scarcity, developer reputation, lifestyle appeal and long-term upside. For an investor targeting long-term value and premium rental demand, it represents a high-potential play.

But — only if you are ready for capital commitment, patience for handover, and long-term holding horizon. It’s less ideal if you seek quick returns or want a highly liquid property.