AL JURF & SHA RESORT

pure resort lifestyle

Discover Al Jurf, a captivating destination where natural forest with wildlife and clear sea blend seamlessly with modern amenities.

Coastal paradise with stunning landscapes. Explore its unique features, attractions, and infrastructure that create a serene prime lifestyle.

LAUNCHED

SHA MANSIONS

Av.starting PRICE: 3'400 AED/sqft, Remaining SIZES from: 8'786 sqft, Handover: Q1 2026, PP: 70/30

SHA RESIDENCES

Av.starting PRICE: 3'100 AED/sqft, Remaining SIZES from: 2900 sqft in 2-Br, HO: Q1 2026, PP: 50/50, 60/40, 50/50

NASSEEM AL JURF

Av.starting PRICE: 1'600 AED/sqft, Remaining SIZES from: 4740 sqft, Handover: Q3 2027, PP: 70/30

OHANA BY THE SEA

Av.starting PRICE: 1'950 AED/sqft, Remaining SIZES from: 2690 sqft in 3-Br Villa. Handover: Q2 2027, PP: 90/10

JACOB&CO VILLAS

Av.starting PRICE: 3'000 AED/sqft. Handover: Q1 2028, PP: 90/10

JACOB & CO RESIDENCES

Av.starting PRICE: 3'000 AED/sqft, Remaining SIZES from: 1001 sqft in 1-Br, Handover: Q1 2028, PP: 70/30

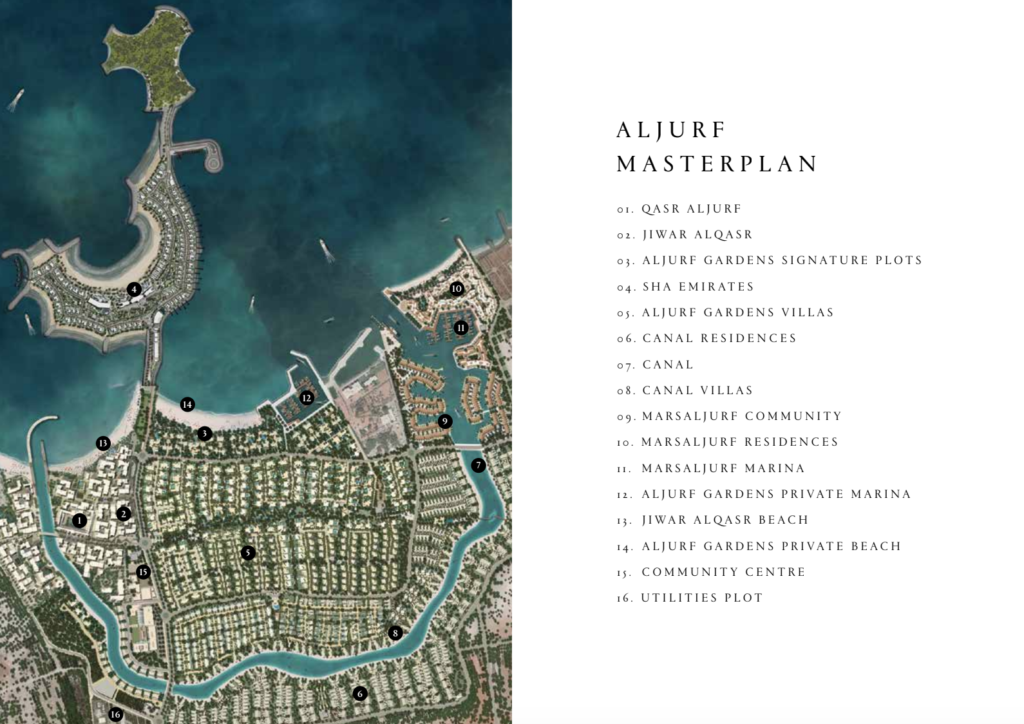

Al Jurf (AlJurf / Al Jurf Gardens) – investor snapshot

What & where: Al Jurf is a large, master-planned coastal destination on the Sahel Al Emarat coastline (between Abu Dhabi and Dubai) developed by IMKAN and partners. The masterplan includes beachfront, marina, parks and low-density villa neighbourhoods (Al Jurf Gardens, Naseem, etc.).

Pros

Riviera-style masterplan & beachfront scarcity – private beach, marina and extensive open space create a clear lifestyle USP that supports premium pricing vs generic suburbs.

Strong developer pedigree & phased delivery – IMKAN’s positioning as a premium experiential developer reduces execution risk compared with unknown builders.

Appeals to second-home, wellness and coastal-living buyers – ideal for buyers seeking holiday homes or lifestyle villas away from dense city cores (good for diversification).

Cons / Risks

Location trade-off (between Abu Dhabi & Dubai) – attractive for second-home buyers but farther from daily-commute hubs; this limits everyday-renter demand compared with Dubai-centric projects.

Higher ticket items & liquidity risk — villas and beachfront plots are premium and lower-turnover; resale can be slower in a cooling market.

Phased development exposure — value appreciation depends on timely delivery of public amenities (marina, retail, transport links) across phases.

Appreciation & yield view

Medium-to-long term upside: scarcity of beachfront + masterplan lifestyle suggests attractive capital preservation and possible premium appreciation over 5-10 years if Sahel Al Emarat develops as promoted. Short-term gains depend on market cycles and delivery milestones.

Tactical recommendation

Buy beachfront/marina-adjacent plots or completed turnkey villas to maximise resale appeal. Stress-test for service charges, access roads and nearest hub connectivity. Treat Al Jurf as a lifestyle/second-home or long-holdallocation in a diversified portfolio.

SHA wellness residences – investor snapshot

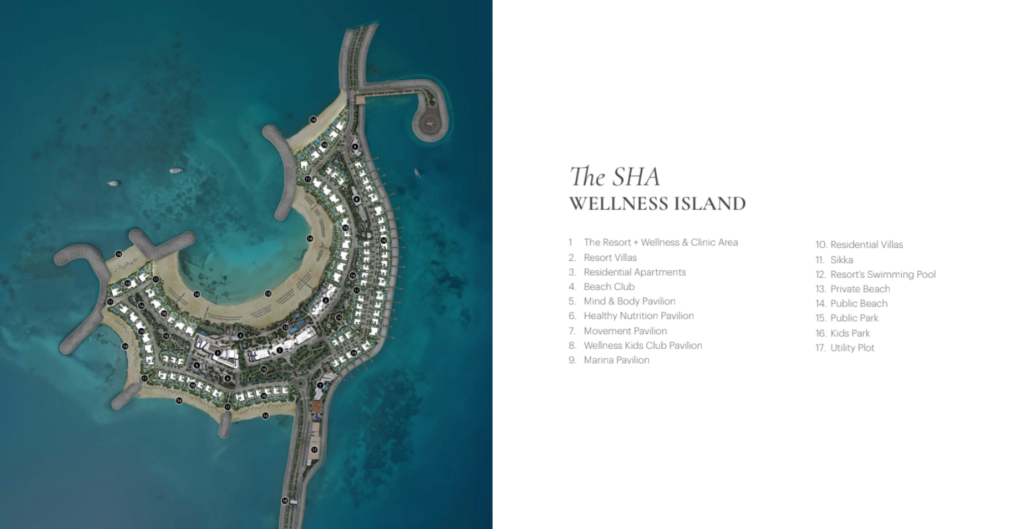

What & where – SHA (the Spanish wellness brand) is partnering on a wellness-led residential offering within Al Jurf – marketed as high-quality, health-centric residences on a wellness island concept (SHA Emirates / SHA Residences). It’s positioned as a global first for integrated, clinical + lifestyle wellness living in the UAE.

Pros

Unique wellness branding & product differentiation — SHA’s clinic-to-residence model (wellness programming, medical/spa services integrated into the community) creates a stand-out, defensible niche in the premium market.

Appeals to ultra-niche premium buyers — health-oriented HNWIs, wellness tourists, and long-stay residents may pay a premium for bona fide medical + preventive care integrated into everyday living.

Synergy with Al Jurf masterplan — SHA benefits from beachfront, private-island positioning and the larger destination’s leisure & marina amenities.

Cons / Risks

Niche demand & narrower buyer pool – wellness-branded residences can command a premium but attract a smaller, more specific audience; resale liquidity may be uneven.

Execution & regulatory dependencies — the project’s success depends on SHA services rollout, licensing, and high operational standards; delays or partial delivery would impair the value proposition.

Price vs yield trade-off — premiums for wellness branding may compress net rental yield (higher purchase price + possibly higher service costs). Evaluate net returns carefully.

Appreciation & yield view

Long-term trophy potential: if SHA delivers a genuine, internationally credible wellness ecosystem, these residences could behave as trophy assets with strong capital preservation. However, expect longer holding periodsand plan for higher carrying costs.

Tactical recommendation

For brand-seeking investors: prioritise early units only if comfortable with project timelines and with a clear marketing plan to reach the wellness buyer segment.

For yield investors: be conservative — run net-yield models that include elevated service charges, low initial occupancy, and a longer time to stable cashflow.

Quick comparative takeaway

Al Jurf (general masterplan) = best for lifestyle/second-home investors seeking beachfront scarcity and masterplan upside — treat as long-hold.

SHA Residences = premium, niche wellness trophy asset — potentially higher price resilience but a narrower market and more execution risk