TILAL AL GHAF

Exclusive Luxurious Living

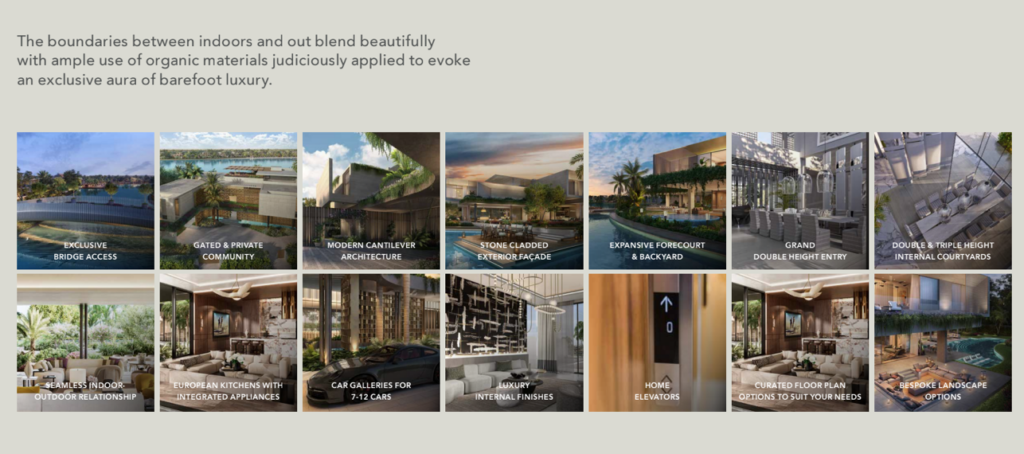

Premium quality villas and mansions in well organized community. Enjoy the tranquility of lush green spaces, the warmth of a close-knit community and the convenience of modern amenities.

Quick summary

Tilal Al Ghaf is Majid Al Futtaim’s master-planned, resort-style community built around Lagoon Al Ghaf with sandy beaches, parks, long walking/cycling trails and mixed housing (villas, townhouses, apartments). It’s designed for family living, wellness and sustainability.

Pros (why investors like it)

Strong developer & brand — Majid Al Futtaim is a reputable regional developer which reduces developer-risk vs unknown builders.

Unique product mix & lifestyle asset — a swimmable central lagoon, beachfront-style public areas, green corridors and sports/leisure facilities increase appeal to high-end tenants and owner-occupiers. This lifestyle differentiation supports premium pricing and demand.

Family-friendly amenity set — international school options, nurseries, healthcare access, retail and F&B planned inside/near the community (good for long-term residential demand).

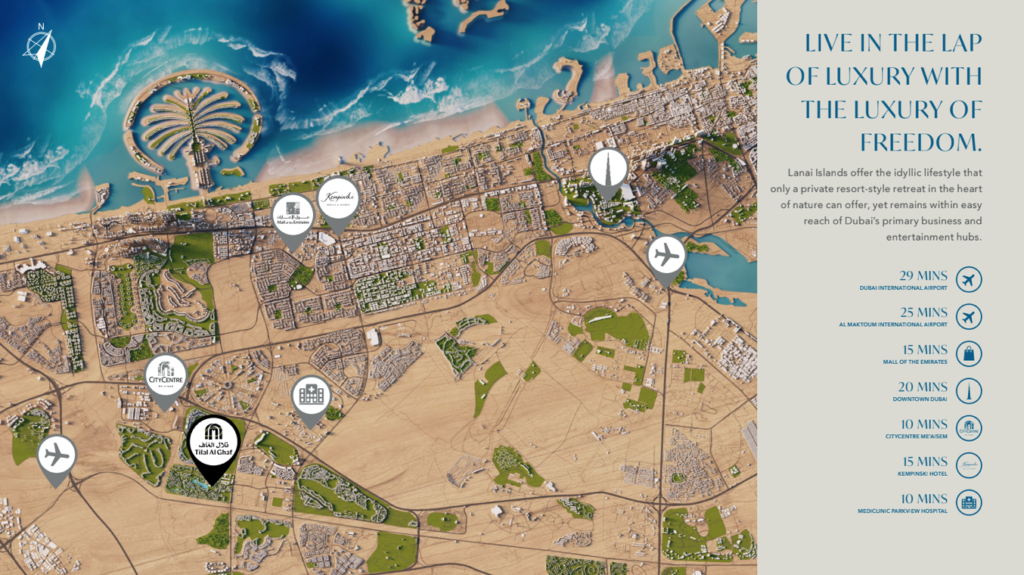

Good connectivity for suburban product — direct links via Hessa St (D61) and nearby highways, ~25–30 min to Downtown/Midtown and convenient access to Dubai’s main corridors for commuters. This balance of calm + accessibility is attractive to families and executives.

Cons / Risks (what to watch)

Premium price bracket → liquidity risk: Tilal Al Ghaf commands above-average prices for townhouses/villas in its submarket, which narrows buyer pool versus mass-market neighbourhoods.

Suburban-style holding dynamics: resale cycles can be slower than apartments in central locations — expect longer time-to-exit in weak markets.

Short-term rental volatility: villa rental occupancies can fluctuate seasonally; yields depend on the exact product, location within the community and furnishing/management quality. Current rental volumes show activity but investors should stress-test cashflow.

Appreciation & yield outlook

Medium–long term upside: product scarcity + high-quality master plan + strong developer backing generally point to steady capital growth over 5–10 years, especially if the lagoon and retail/leisure components fully deliver.

Rental picture: available transaction data shows active villa rentals (total volumes rising year-on-year), but yields will be lower than small-unit apartments — expect moderate gross yields that improve if you target furnished, family-oriented leases and manage vacancy tightly.

Neighbourhood & micro-location notes

Masterplan character: low-density, walkable neighbourhood pockets around the lagoon; the best plots are lagoon-facing or those near the main Park/amenities.

Competition: other premium suburban communities (Arabian Ranches / Jumeirah Golf Estates / parts of Dubailand) compete on price and lifestyle — Tilal Al Ghaf’s lagoon is a unique selling point but compare exact product specs (plot sizes, finishes, service charges).

My short recommendation (for investors)

Best for: buy-and-hold investors seeking capital appreciation + stable family rental demand; HNW owner-occupiers wanting resort-style living.

Avoid if: you need quick flips or highly liquid assets.

Tactical tips: prioritise lagoon-facing or park-adjacent units; secure a professional property manager for furnished rentals; verify service charges and community maintenance plans before purchase.